There’s a cryptocurrency called Made in America (MIA) - and if you’ve seen it pop up on a price tracker, you might be wondering if it’s real, worth buying, or just another ghost token. The name sounds powerful. It leans into patriotism, craftsmanship, American pride. But behind the branding, the reality is far less impressive. As of early 2026, MIA isn’t a movement. It’s not even a project with momentum. It’s a digital token with almost no trading activity, no public team, and no clear purpose beyond the name.

What Is Made in America (MIA) Exactly?

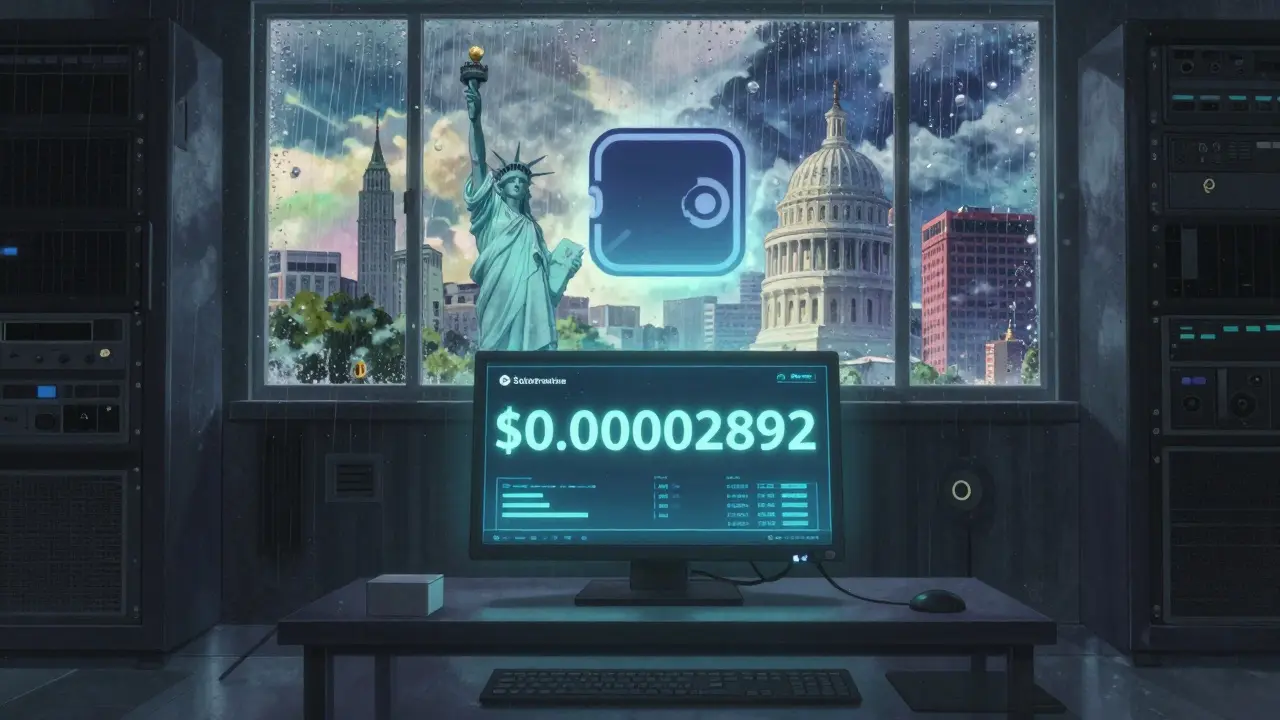

Made in America (MIA) is a cryptocurrency token built on the Solana blockchain. That means it doesn’t have its own network. It runs on top of Solana, using Solana’s speed and low fees to move coins around. Solana can handle thousands of transactions per second for pennies, so technically, MIA could work well - if anyone actually used it. The token’s official story claims it’s more than money. It’s supposed to represent resilience, innovation, and the spirit of American-made products. The website and social channels (if you can find them) talk about financial freedom and national pride. But there’s no whitepaper. No roadmap. No team names. No GitHub repo. No developer updates. Just a slogan wrapped in a token.Where Can You Buy MIA?

As of early 2026, MIA is listed on two exchanges: Poloniex and possibly LBank. Poloniex started trading MIA/USDT on January 31, 2025. That was the first real chance for people to buy or sell it. But here’s the catch: since then, trading volume has hovered around zero. CoinMarketCap shows $0 in 24-hour volume. LiveCoinWatch says it peaked at $0.000060 once, but that was months ago. The current price? Around $0.00002892. That’s less than 1/3000th of a cent. You’d need over 34,000 MIA tokens to make one dollar. And even if you bought 10 million of them, you’d still have less than $300. There’s no liquidity pool on Uniswap or Raydium. No DeFi staking. No NFT integrations. No merchant acceptance. No wallet integrations beyond basic Solana wallets like Phantom or Solflare. If you buy MIA, you’re not investing in a product. You’re buying a digital collectible with no utility.Why Does It Even Exist?

The crypto market is flooded with tokens like this. Every week, hundreds of new coins launch on Solana, Ethereum, Base, and others. Most are created by anonymous teams with no intention of building anything long-term. They’re launched to attract speculative buyers, pump the price briefly, then vanish. MIA fits that pattern perfectly. It uses emotional branding - patriotism - to stand out in a sea of meaningless tokens. It’s not unique in that. There are tokens named “American Flag Coin,” “USA Crypto,” “Liberty Token,” and dozens more. Most die within weeks. A few survive because they get lucky with a viral tweet or a celebrity mention. MIA hasn’t had either. No major crypto news site has covered it. No analysts have rated it. No Reddit threads discuss it. No Telegram groups have more than a few dozen members. Even scam alert sites don’t mention it - not because it’s safe, but because it’s too insignificant to bother with.Market Data Tells the Real Story

Let’s look at the numbers:- Price: $0.00002892 (as of January 2026)

- 24-Hour Volume: $0 (CoinMarketCap)

- Market Cap Rank: #7204-#8820 (varies by platform)

- Blockchain: Solana

- Exchange Listings: Poloniex (confirmed), LBank (unconfirmed)

- Token Supply: Unknown

- Smart Contract: Not publicly documented

Can You Store MIA Safely?

Technically, yes. Since it’s a Solana token, you can store it in any wallet that supports Solana: Phantom, Solflare, Backpack, or even Ledger hardware wallets if you’ve enabled Solana support. But storing it doesn’t mean it’s safe. There’s no official contract audit. No security review. No insurance. No team to contact if something goes wrong. If the Solana network crashes, MIA disappears with it. If Poloniex delists it - which they can do at any time - your tokens become worthless digital artifacts. There’s no recovery plan. No customer support. No backup. Just a wallet address and a prayer.Is MIA a Scam?

It’s not labeled as a scam by regulators or watchdogs - because it’s too small to attract their attention. But it ticks every box for a “pump and dump” or “rug pull” candidate:- No public team or founders

- No technical documentation

- No roadmap or development updates

- No community engagement

- No utility or real-world use

- Zero trading volume

What’s the Bottom Line?

Made in America (MIA) isn’t a crypto project. It’s a digital placeholder. A name on a blockchain with no purpose, no people, and no future. It’s not going to make you rich. It’s not going to change your financial life. It’s not even going to give you a story to tell. If you’re looking for a crypto that represents American values - innovation, resilience, independence - look at Bitcoin. Look at Ethereum. Look at projects with real teams, real code, and real users. MIA doesn’t represent anything except the noise of the crypto market. Don’t buy MIA because it sounds patriotic. Buy crypto because it’s useful, transparent, and backed by real development. MIA is just a flag on an empty battlefield.

Should You Invest in MIA?

No. If you’re thinking of buying MIA because you saw a meme or a price chart that looked like it might rise - don’t. You’re not investing. You’re gambling on a token that has no foundation. The odds aren’t just stacked against you. They’re nonexistent. If you already own MIA, consider it a learning experience. The market is full of tokens that look like opportunities but are really just distractions. The best move? Cut your losses, move your funds to a wallet you control, and walk away.What to Do Instead

If you want to support a crypto that aligns with values like freedom, innovation, or decentralization, look at projects with:- Public development teams with LinkedIn profiles

- Open-source code on GitHub

- Active community channels (Discord, Telegram)

- Real use cases (payments, DeFi, identity, etc.)

- Trading volume above $1 million daily

- Listing on major exchanges like Coinbase, Kraken, or Binance

Final Thought

The American spirit isn’t in a token. It’s in the people who build, create, and persist. Crypto can be a tool for that - but only if you choose wisely. MIA doesn’t represent the American dream. It represents the noise that comes with it.Is Made in America (MIA) a real cryptocurrency?

Yes, technically. MIA is a token on the Solana blockchain with a contract address and an exchange listing on Poloniex. But it has no team, no development, no community, and zero trading volume. It exists on paper - but not in practice.

Can I make money with MIA coin?

Almost certainly not. The 24-hour trading volume is $0, meaning there’s no market to sell into. Even if the price rises slightly, no one is buying. Without buyers, you can’t cash out. Any profit you think you’ve made is theoretical.

Is MIA listed on Coinbase or Binance?

No. MIA is only confirmed on Poloniex, and possibly LBank. It is not listed on any major exchange like Coinbase, Binance, Kraken, or KuCoin. That’s a red flag - reputable exchanges vet projects before listing them.

How do I store MIA tokens?

You can store MIA in any Solana-compatible wallet like Phantom, Solflare, or Ledger (with Solana enabled). But since there’s no official contract audit or team, storing it doesn’t make it safe. Treat it like digital trash unless you’re prepared to lose it entirely.

Why is MIA’s price so low?

Because no one is trading it. The price reflects zero demand. Tokens like MIA often have extremely low prices because their total supply is massive - sometimes in the trillions - so each unit is worth fractions of a cent. Low price doesn’t mean cheap. It means worthless.

Is MIA a scam or rug pull?

It hasn’t been labeled as one because it never had enough traction to trigger alerts. But it has all the hallmarks: anonymous team, no code, no updates, no liquidity, no community. It’s not a scam because it’s too small to be worth stealing from - it’s just dead on arrival.

Can I stake MIA to earn rewards?

No. There are no staking programs, yield farms, or DeFi integrations for MIA. No platform offers rewards for holding it. Any claim that you can earn interest on MIA is false.

What happened to the MIA team?

There is no public information about the team. No names, no LinkedIn profiles, no Twitter accounts, no GitHub commits. The project was launched anonymously and has been silent since its listing in January 2025. This is extremely common for micro-cap tokens that are never meant to last.