DePHY Network (PHY) isn’t another meme coin or a copycat blockchain. It’s a niche project trying to solve a very specific problem: connecting real-world hardware to AI and blockchain systems without the usual delays, costs, or complexity. If you’ve ever wondered how a solar panel, a temperature sensor, or a drone could talk directly to a smart contract, DePHY is one of the few projects actually building that bridge.

What DePHY Network Actually Does

DePHY Network (PHY) is a decentralized protocol designed to make it easy for developers to build DePIN - short for Decentralized Physical Infrastructure Networks. Think of DePIN as the backbone for physical devices that need to interact with blockchain technology. Instead of relying on slow, centralized servers, DePHY lets devices like sensors, routers, or energy meters communicate directly with blockchains using their own secure, peer-to-peer network.

The big win? Speed. DePHY claims a latency of just 500 milliseconds. That’s faster than most blockchains, which often take seconds or even minutes to confirm transactions. For applications like real-time energy grid management or live AI data feeds, that speed matters. If you’re training an AI model that needs live weather or traffic data, waiting 10 seconds for a data point is too long. DePHY cuts that down to half a second.

It’s not just about speed, though. DePHY also handles security at the hardware level. Each device connected to the network gets a unique digital identity verified through Trusted Execution Environments (TEEs) and Zero-Knowledge (ZK) oracles. This means you can trust the data coming from a sensor without needing to rely on a single company to vouch for it. The system checks the data’s origin and integrity automatically.

How the DePHY Ecosystem Works

The network runs on three main pieces:

- Open-source hardware designs - These are blueprints for building cheap, secure devices that can plug into the DePHY network. Developers don’t need to design chips or circuits from scratch; they can use these templates to make their own hardware.

- Decentralized messaging layer - This is the communication backbone. It lets devices send data to each other and to blockchains without going through a central server. It’s built to be fast, secure, and resistant to tampering.

- Automated tokenomics tools - These let developers create reward systems for users who contribute hardware or data. Want to pay people to run a weather station that feeds data to your AI? DePHY gives you the tools to set up those payments automatically using PHY tokens.

As of late 2023, the network had over 50,000 active nodes running DePHY’s stack. These aren’t just computers - they’re physical devices like edge servers, gateways, and sensors spread across the globe. They’re the ones handling data transfer, verifying identities, and keeping the network running.

What Is PHY Token Used For?

PHY is the fuel of the DePHY network. It’s not meant to be a currency you use to buy coffee. Its job is to power the ecosystem:

- Staking - Users can lock up PHY tokens to help secure the network and earn rewards. This is similar to how Ethereum staking works, but focused on hardware participation.

- Payment for services - Developers pay for data from physical devices using PHY. If you run a sensor that tracks air quality and sell that data to an AI company, you get paid in PHY.

- Access to tools - Some of DePHY’s software development kits (SDKs) and API tools require PHY to unlock features like custom incentive pools or governance voting.

- Trading - Right now, most people hold PHY for speculative reasons. It’s traded on exchanges like Bitget, MEXC, and LBank, mostly against USDT.

There are 1 billion PHY tokens total, but only 72.29 million are in circulation as of late 2023. That means over 90% of the supply is still locked up - likely reserved for future development, team incentives, or ecosystem growth. The fully diluted valuation (FDV) is around $1.65 million, which tells you how much the project would be worth if all tokens were released today.

Market Reality: Tiny, Volatile, and Risky

Let’s be clear: DePHY is not Bitcoin. It’s not even close to Ethereum or Solana. As of November 2023, its market cap hovered around $130,000. That puts it at #2955 on CoinMarketCap - near the bottom of the entire crypto list. For comparison, the top 100 coins each have market caps in the billions.

Trading volume is inconsistent. CoinMarketCap reported $314,000 in 24-hour volume, while CoinGecko showed over $8 million. That kind of discrepancy is a red flag. It could mean fake trading, bot activity, or poor data reporting - all signs of a low-liquidity, high-risk asset.

PHY’s price has dropped 97% from its all-time high of $0.0740. Today, it trades between $0.0016 and $0.0022. That’s not a typo. A single trade can move the price 10% or more. This isn’t investing - it’s gambling with a side of technology.

There are only about 20,000 holders. That’s a tiny community. You won’t find deep discussions on Reddit or Twitter. Most people who talk about it are either developers building on it or traders trying to scalp quick gains.

Who Should Care About DePHY?

If you’re a retail investor looking for the next 100x coin, walk away. DePHY is too small, too volatile, and too unproven.

But if you’re a developer working on DePIN projects - like decentralized energy grids, smart city sensors, or AI-powered logistics - then DePHY could be worth your time. It’s one of the few platforms built from the ground up to connect hardware and blockchain without the usual headaches.

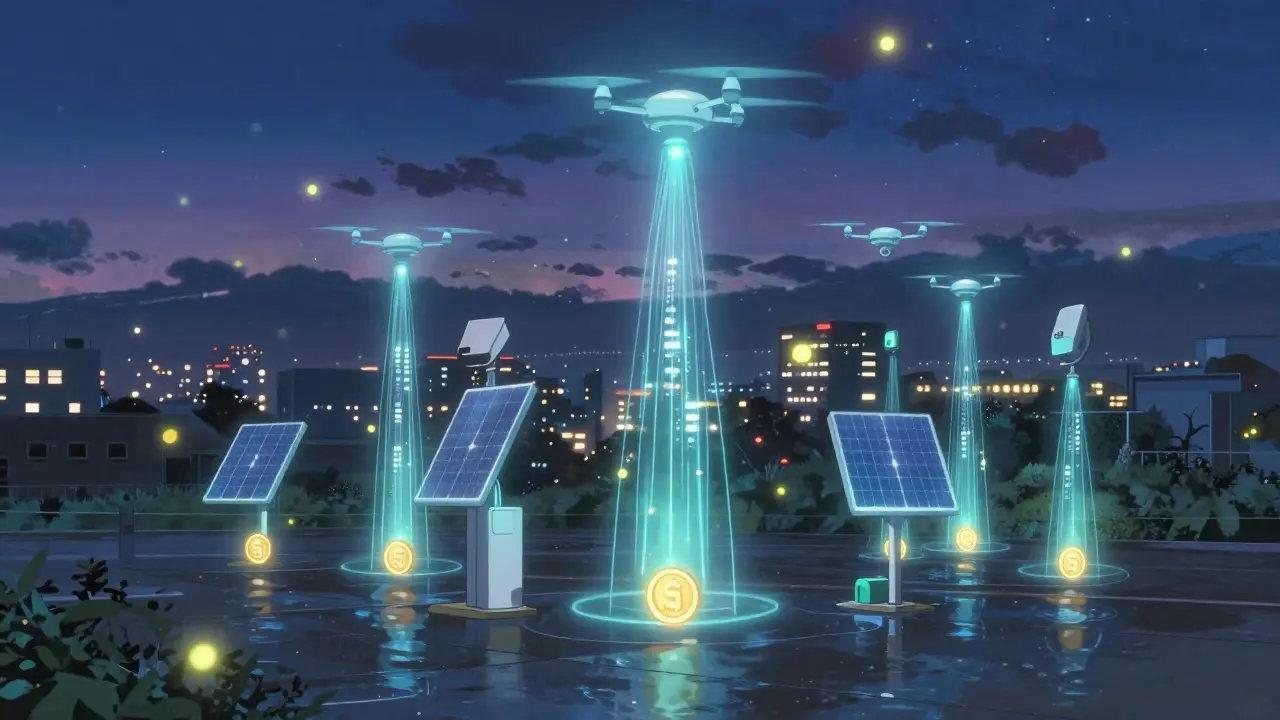

Companies using DePHY are likely small startups or research teams. There’s no big-name brand like Tesla or Google using it yet. But the concept is real: imagine a network where your home solar panel earns you crypto for feeding excess power into a decentralized grid. Or your car’s sensors sell traffic data to an AI traffic model. That’s the future DePHY is trying to build.

How Does It Compare to Other DePIN Projects?

DePHY isn’t the only player in DePIN. Here’s how it stacks up:

| Project | Focus | Latency | Market Cap (Late 2023) | Key Advantage |

|---|---|---|---|---|

| DePHY Network (PHY) | AI + DePIN infrastructure | 500ms | $130K | Fastest data sync for AI apps |

| Helium (HNT) | Wireless hotspots | Seconds | $320M | Large user base, proven model |

| Render (RNDR) | GPU power sharing | Seconds | $850M | Used by major studios and AI firms |

| DIMO (DIMO) | Car data sharing | Seconds | $110M | Strong partnerships with auto manufacturers |

DePHY’s edge is speed and AI focus. But it’s also the smallest. Helium and Render have real users, real revenue, and institutional backing. DePHY is still in the prototype phase.

Can You Buy PHY Right Now?

Yes, but it’s not easy or safe. You can buy PHY on exchanges like Bitget, MEXC, and LBank. Just search for PHY/USDT. You’ll need a crypto wallet like MetaMask or Trust Wallet to store it.

But here’s the catch: liquidity is thin. If you try to sell a large amount, the price will crash. You might not get what you expect. And because there’s so little trading volume, it’s easy for prices to be manipulated.

Some exchanges offer staking for PHY. Bitget, for example, lets you lock up your tokens and earn interest. That’s probably the safest way to interact with PHY - if you’re willing to accept the risk.

Is DePHY the Future of AI and Hardware?

The idea behind DePHY is compelling. AI needs real-world data. Real-world data needs sensors. Sensors need secure, low-cost ways to connect to blockchains. DePHY is one of the few projects trying to solve all three problems at once.

But having a good idea doesn’t mean it will succeed. Most crypto projects fail. DePHY’s biggest challenge isn’t technology - it’s adoption. Without developers building on it, without hardware makers using its designs, and without real users contributing data, it’s just a nice whitepaper.

Its future depends on whether AI companies start using it to fetch live data. If a major AI lab begins using DePHY to power its models with real-time sensor feeds, that could be the turning point. Until then, it’s a high-risk bet on a very specific future.

Is DePHY Network (PHY) a good investment?

As of early 2026, DePHY is not a good investment for most people. It’s extremely small, volatile, and lacks real adoption. Only experienced traders who understand high-risk, low-liquidity assets should consider it - and even then, only with money they can afford to lose. It’s speculative, not strategic.

Can I mine or stake PHY tokens?

You can’t mine PHY - it’s not a proof-of-work coin. But you can stake it on exchanges like Bitget to earn rewards. Staking helps secure the network and gives you passive income. However, because the token’s value is so unstable, your earnings could be wiped out by a price drop.

What makes DePHY different from other blockchains?

Most blockchains focus on transactions or smart contracts. DePHY focuses on connecting physical devices - like sensors, cameras, or energy meters - to blockchains with ultra-low latency (500ms). It’s built for real-time data, not just payments. Its use of hardware-level security and ZK oracles also sets it apart from general-purpose chains.

Is DePHY related to AI?

Yes, deeply. DePHY’s biggest push is to become the infrastructure layer that lets AI models access real-world data - like traffic patterns, weather, or energy usage - directly from physical devices. It’s building what it calls the world’s first decentralized MCP service mesh, which acts as a bridge between AI systems and physical sensors.

Where can I find official DePHY documentation?

Official documentation is mostly aimed at developers and hosted on DePHY’s GitHub and developer portal. There’s little to no investor-focused material. If you’re not a coder, you’ll find it hard to get clear answers about how the network works or how to use it. The exchanges that list PHY offer basic guides, but they’re not technical.

Final Thoughts

DePHY Network is not for everyone. It’s not a store of value. It’s not a payment network. It’s a tool for developers building the next generation of hardware-connected AI systems. If you’re a crypto enthusiast looking for the next big thing, you’ll probably be disappointed. But if you’re a builder - someone who cares about how sensors talk to machines, and how machines talk to AI - then DePHY might be one of the few projects worth watching.

The technology is real. The need is real. But the market? Still tiny. And that’s the biggest risk of all.

Rajappa Manohar

January 3, 2026 AT 14:09phy? heard of it. looks like someone tried to merge iot with crypto and forgot to test the wifi.

Andrea Stewart

January 5, 2026 AT 12:35Actually, this is one of the more technically sound DePIN projects out there. The 500ms latency is legit - most blockchains are 10-30 seconds. The ZK oracles and TEEs are real security layers, not just buzzwords. Developers working on edge AI or real-time sensor networks should seriously check out the GitHub repo. It’s not a flip coin, it’s a tool. And tools don’t need 10M holders to be valuable.

SUMIT RAI

January 6, 2026 AT 17:55LOL 130k market cap?? 😂 Bro, if this is the future, I want my money back from my NFT ape. 🤡🚀 #phytothemoon

Ryan Husain

January 6, 2026 AT 18:01While the market cap is indeed minuscule, the underlying architecture deserves attention. The integration of hardware-level identity verification via TEEs and zero-knowledge proofs is a significant advancement over centralized IoT platforms. Most existing solutions rely on trust in third-party data providers - DePHY eliminates that single point of failure. For enterprise-grade sensor networks, this could be transformative. The challenge is adoption, not technology.

Josh Seeto

January 8, 2026 AT 12:34Oh wow, a crypto project that actually solves a problem? Next they’ll tell me blockchain can fix traffic jams. 🙄

Let me guess - the team’s still living off their 2021 crypto gains, and the ‘real use case’ is just a demo running on a Raspberry Pi in someone’s garage. The ‘500ms latency’ is probably measured with a stopwatch while the server is on the same desk as the sensor.

surendra meena

January 9, 2026 AT 05:45THIS IS THE FUTURE!!! PHY WILL HIT 10 DOLLARS!!! THE SENSORS ARE ALREADY TALKING TO THE BLOCKCHAIN!!! THE AI IS LISTENING!!! WE ARE THE CHOSEN ONES!!! 😭🔥🔥🔥

AND IF YOU DON’T BUY NOW YOU’RE A COWARD AND A HATER AND YOU HATE FREEDOM AND THE INTERNET!!!

Joydeep Malati Das

January 9, 2026 AT 07:40The project has potential, but the current market dynamics make it difficult to evaluate its long-term viability. The low liquidity and inconsistent volume metrics suggest either weak adoption or questionable reporting. For now, it’s best to observe rather than participate. If major AI labs begin integrating DePHY’s infrastructure in the next 12–18 months, that’s when the real signal will emerge.

rachael deal

January 9, 2026 AT 18:45Y’all are overthinking it. Look - if you’re a dev building something that needs real-time sensor data, this is one of the few tools that actually works. No fluff, no vaporware. Just code, hardware blueprints, and a token that pays people for sharing data. I’ve seen prototypes where a weather station in rural Kansas feeds AI models in Berlin using PHY - and it’s fast, secure, and cheap. That’s not magic. That’s engineering. If you’re not building something like this, you’re just watching the show.