Crypto Exchange Safety Checker

Is This Exchange Safe?

Check if a crypto exchange meets basic safety criteria based on the article's findings about UPEX's failure.

Safety Assessment

UPEX was supposed to be the go-to crypto exchange for the Middle East and North Africa. Launched in 2018 by a company called OneMena and based in Bahrain, it promised Arabic language support, AED trading pairs, and a local touch that big global exchanges didn’t offer. At one point, it claimed to have 300,000 users. But today, in 2025, UPEX doesn’t exist as a functioning platform. No trades. No deposits. No customer support. Just a website that loads slowly-or doesn’t load at all-and a ghost town of abandoned accounts.

What UPEX Actually Offered (When It Was Alive)

When UPEX was running, it wasn’t flashy. It didn’t have hundreds of coins like Binance or complex derivatives like Bybit. But it did have one real advantage: it spoke Arabic. For users in Saudi Arabia, Egypt, or the UAE who weren’t comfortable with English interfaces, UPEX was one of the few exchanges that made sense. It also supported trading in AED, which meant you could buy Bitcoin or Ethereum directly with UAE Dirhams without jumping through currency conversion hoops.

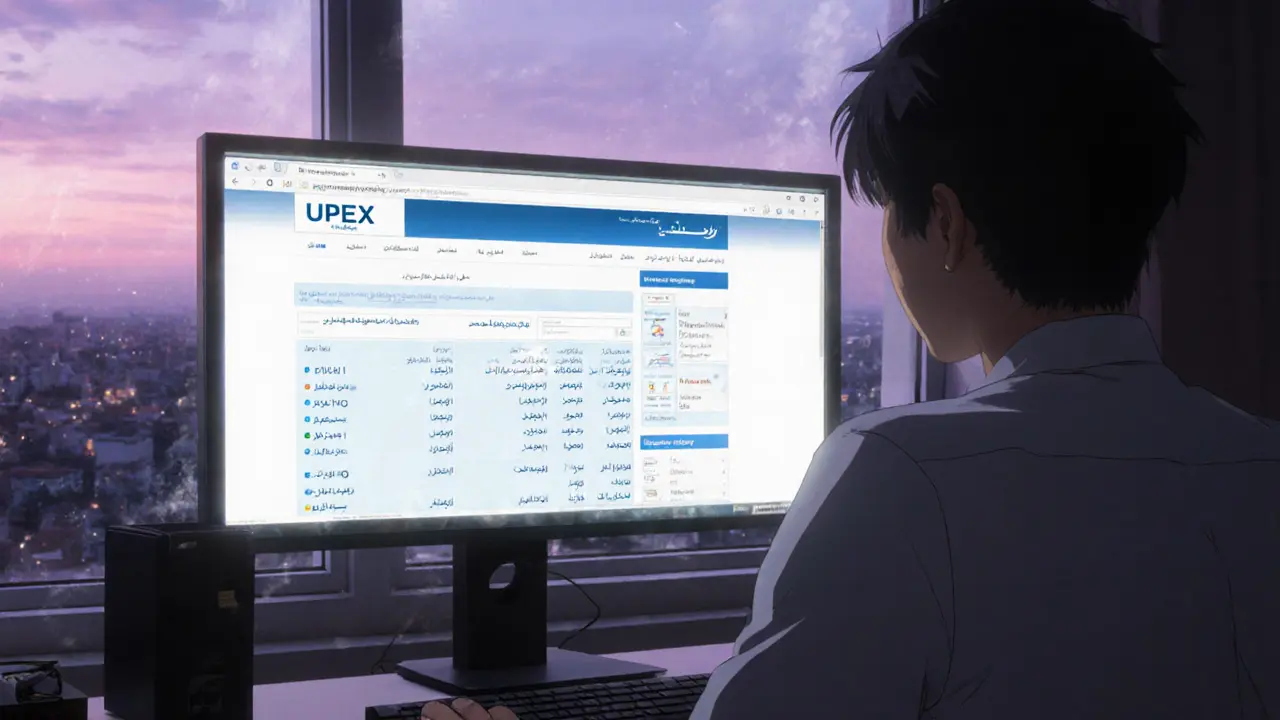

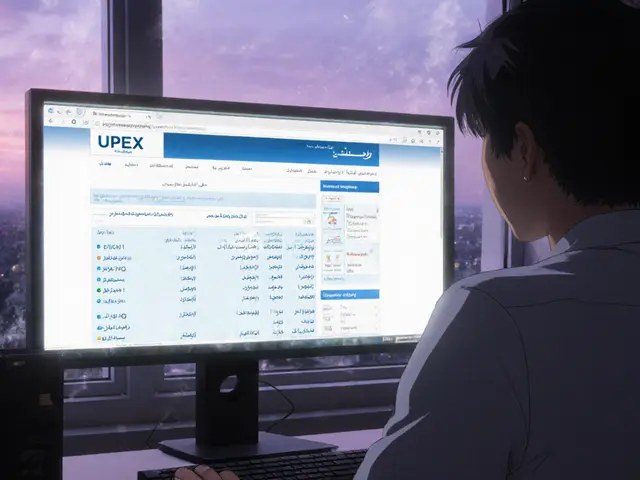

The platform had a standard desktop interface-order book, price chart, buy/sell buttons. It also claimed to have a mobile app, but no one seems to remember using it. Most trading happened on desktop. The UI wasn’t revolutionary, but it worked well enough for basic spot trading. If you were just buying and holding crypto, you could get by.

OneMena, the company behind UPEX, said it was part of the Central Bank of Bahrain’s regulatory sandbox. That sounds official. But here’s the problem: no one could explain what that actually meant. Was it licensed? Was it supervised? Did it follow anti-money laundering rules? The exchange never provided clear documentation. Even industry reviewers like Cryptowisser admitted they weren’t sure what the sandbox status meant. That ambiguity became a red flag.

The Slow Collapse: What Went Wrong?

By 2021, things started falling apart. Trading volumes dropped. Customer support stopped replying. Updates on social media vanished. The website stayed online, but it became a shell. No new coins were added. No new features launched. No announcements. Just silence.

By 2022, CoinMarketCap stopped tracking UPEX’s trading volume. The listing changed from “tracked” to “untracked.” That’s a big deal. It means the data aggregators-companies that monitor every exchange worldwide-decided UPEX wasn’t doing any real business anymore. No trades. No liquidity. No reason to list it.

ICORankings, a crypto exchange review site, summed it up bluntly: “Post-2021, it’s ceased functioning.” That’s not a rumor. That’s a fact based on data. Myfxbook, another financial data provider, lists UPEX under “Closed Crypto Exchanges.” Zero user reviews. Zero activity. Zero hope.

Compare that to Rain, a UAE-based exchange that got full licensing from the Abu Dhabi Global Market (ADGM) in 2022. Rain grew to over a million users. It had clear rules, transparent operations, and real customer service. UPEX had none of that. It tried to be the local hero but never built the foundation to stay one.

Why UPEX Failed When Others Succeeded

The MENA crypto market was growing fast. In 2023, transaction volumes hit $1.2 billion. But only exchanges with real regulation survived. Binance MENA, BitOasis, and Rain all secured formal licenses. They hired compliance teams. They published audit reports. They answered questions from regulators.

UPEX didn’t. It relied on vague claims about being in a “sandbox.” That’s not a license. It’s a trial run. And if you don’t pass the trial, you get kicked out. There’s no evidence UPEX ever passed. No press releases from the Central Bank of Bahrain confirming its status. No regulatory filings. No public audit.

Another problem: liquidity. Crypto exchanges need buyers and sellers. If no one’s trading, the price doesn’t move. If the price doesn’t move, traders leave. UPEX never built enough volume to sustain itself. Even its claimed 300,000 users? No one’s seen proof. No Reddit threads. No Trustpilot reviews. No forum discussions from real users. That number feels made up.

Can You Still Use UPEX Today?

No.

Try visiting https://ex.upex.io/. The site might load, but you won’t be able to log in. Deposits won’t go through. Withdrawals? Forget it. The app isn’t on the Apple App Store or Google Play anymore. Even if you still have an old account, your funds are likely gone-or locked forever.

There’s no customer service email. No live chat. No phone number. No social media activity since 2021. The company behind it, OneMena, has disappeared from LinkedIn. No press releases. No interviews. No answers.

If you ever used UPEX, you’re probably out of luck. There’s no recovery process. No official statement about refunds. No legal recourse listed anywhere. It’s a complete dead end.

What This Means for Crypto Users in the MENA Region

UPEX’s collapse isn’t just a footnote. It’s a warning.

Many people in the Middle East still trust local exchanges because they feel more “relatable.” But being local doesn’t mean being safe. UPEX was local. It spoke Arabic. It accepted AED. And it vanished without a trace.

The lesson? Always check for real regulation. Look for licenses from recognized financial authorities-not sandbox programs that mean nothing. Ask: Is this exchange registered with the Central Bank? Is it audited? Does it have a clear legal structure? If you can’t find answers, walk away.

Today, the best options in the region are Rain (UAE), BitOasis (UAE), and Binance MENA. All have clear licenses. All have active customer support. All have real trading volume. None of them promise the moon and then disappear.

Final Verdict: Avoid UPEX Completely

UPEX was never a top-tier exchange. But it had potential. It had the right market, the right language, the right currency. What it didn’t have was integrity. It didn’t have transparency. And it didn’t have the discipline to keep running after the initial hype faded.

As of 2025, UPEX is dead. Not just inactive. Not just struggling. Dead.

If you’re looking for a crypto exchange in the MENA region, don’t waste time on UPEX. Don’t even click its website. Your money and your data aren’t safe there. Instead, choose a platform that’s still alive, still regulated, and still answering questions. Your future self will thank you.

Is UPEX still operational in 2025?

No, UPEX is not operational. As of 2025, the exchange has been inactive since 2021. Its website is unreachable or non-functional, trading volumes are zero, and all major data providers like CoinMarketCap and Myfxbook classify it as a closed or untracked exchange. No deposits, withdrawals, or customer support are available.

Did UPEX have a license from the Central Bank of Bahrain?

UPEX claimed to be part of the Central Bank of Bahrain’s regulatory sandbox, but there is no public record or official confirmation that it received a license. The sandbox is a testing program, not a license, and UPEX never demonstrated compliance beyond initial claims. No regulatory filings or audits were ever made public, leaving its legal status ambiguous and unverified.

Can I recover my funds from UPEX?

There is no known way to recover funds from UPEX. The platform has no customer service, no legal contact, and no official communication about asset recovery. Since the exchange ceased operations without notice, users are effectively locked out of their accounts with no recourse or refund process available.

Why did UPEX fail while other MENA exchanges succeeded?

UPEX failed because it relied on vague regulatory claims instead of real compliance. It never secured a formal license, didn’t publish audits, and stopped updating its platform after 2021. In contrast, exchanges like Rain and BitOasis obtained full licensing from regulators like ADGM, maintained transparency, and kept their services running-earning user trust and market share.

Is UPEX’s website still active?

The website ex.upex.io may load, but it’s non-functional. You cannot log in, deposit, withdraw, or contact support. The site appears abandoned, with no updates, no security patches, and no evidence of ongoing operations. It is essentially a digital tomb.

Are there any alternatives to UPEX in the MENA region?

Yes. Rain (UAE), BitOasis (UAE), and Binance MENA are all active, regulated, and trusted alternatives. They offer Arabic support, AED trading pairs, proper licensing, and real customer service. These platforms have proven they can operate sustainably, unlike UPEX.

Elizabeth Mitchell

October 28, 2025 AT 18:11Wow, this is such a sobering reminder that local doesn’t mean safe. I used to think if an exchange spoke Arabic and took AED, it was trustworthy. Turns out, all that matters is whether they’re actually regulated. UPEX was basically a fancy-looking ghost town with a website.

Still, it’s wild how many people fell for it. I guess when you’re new to crypto, you latch onto anything that feels familiar.

Chris Houser

October 30, 2025 AT 04:42As someone from Nigeria, I’ve seen this play out a dozen times. Local exchanges pop up, promise easy access, and vanish before you can withdraw. The real lesson? Never trust a platform that can’t show you a license number. If they’re hiding behind ‘sandbox’ buzzwords, run.

UPEX didn’t fail because of competition-it failed because it was built on smoke and mirrors.

Santosh harnaval

October 30, 2025 AT 06:24Dead exchange. No recovery. No emails. Just a website that loads like a dial-up modem. Classic.

angela sastre

October 31, 2025 AT 05:02UPEX was the classic case of ‘looks good on paper but falls apart in practice.’ I remember seeing ads for it in Dubai metro stations back in 2019. Everyone was excited. Then-poof. Nothing.

Here’s the thing: if you’re in MENA and you want to trade crypto, go with Rain or BitOasis. They have real offices, real support teams, and actual compliance docs you can download. UPEX? You couldn’t even find their CEO’s LinkedIn.

Also, if you still have funds there? You’re not alone. But there’s no legal path. Don’t waste your time chasing ghosts. Move on. Your peace of mind is worth more than whatever was in that wallet.

Aniket Sable

October 31, 2025 AT 07:06bro upeX was the only one that made sense for me back then... i didnt speak english well and they had arabic... now i use rain and its way better. just wish i got my money out before they shut down 😔

Mike Kimberly

November 1, 2025 AT 07:18It’s worth noting that UPEX’s collapse wasn’t an anomaly-it was inevitable. Regulatory sandboxes are not licenses; they’re probationary trials with no guarantee of approval. Many jurisdictions, including Bahrain, use them to test fintech innovation without granting legal authority. UPEX mistook participation for legitimacy.

Compare that to ADGM’s licensing regime in Abu Dhabi, which requires audited financial statements, KYC/AML compliance, capital reserves, and regular reporting. Rain and BitOasis didn’t just ‘succeed’-they met the minimum threshold of institutional responsibility. UPEX didn’t even attempt it.

The tragedy isn’t just the lost funds-it’s the erosion of trust in the entire regional crypto ecosystem. New users now associate ‘local exchange’ with ‘scam,’ when in reality, legitimate ones exist. UPEX didn’t just fail-it poisoned the well for everyone else.

Edwin Davis

November 2, 2025 AT 20:17Why do we even let these ‘local’ scams happen? America doesn’t have this problem because we have real regulators. This is what happens when you let third-world countries play with finance. No oversight. No accountability. Just some guy in a basement saying ‘we’re in the sandbox’ like that means something. UPEX was a joke-and now it’s a graveyard.

John E Owren

November 4, 2025 AT 04:33I’ve been watching crypto exchanges since 2017. The ones that last are the ones that treat compliance like their oxygen, not a checkbox. UPEX treated regulation like a marketing slogan. They didn’t build infrastructure-they built hype.

And now? The silence is deafening. No press releases. No emails. No LinkedIn. It’s like they evaporated. That’s not a business failure. That’s a betrayal.

emma bullivant

November 4, 2025 AT 15:10what if… the whole thing was a honeypot? like… what if they collected all the wallets and then just… vanished? i mean, no one ever saw the backend code, right? and if they were never audited… could they have just been mining crypto under the guise of an exchange? i think we’re missing the real story here…

Claymore girl Claymoreanime

November 4, 2025 AT 20:43Of course it failed. You can’t build a financial institution on ‘Arabic support’ and a pretty logo. People who think local = trustworthy are the same ones who buy NFTs of monkeys. UPEX was a Ponzi dressed in a thobe. And now, because of them, real regulated platforms have to fight harder to prove they’re not scams. You don’t get to be ‘the local hero’ if you’re just stealing people’s ETH.

Will Atkinson

November 6, 2025 AT 06:38It’s heartbreaking, honestly. UPEX had the perfect recipe: language, currency, regional focus. But they forgot the most important ingredient: integrity.

I remember when I first signed up-I thought, ‘Finally, someone gets us.’ Now I just feel sad. Not because I lost money-I didn’t use it-but because so many people did. And now, when a new user asks me for advice, I have to tell them: ‘Don’t trust the nice interface. Check the license.’

It’s a shame. The region deserves better. And honestly? The ones who built UPEX should be held accountable. Not just for the money, but for the broken trust.

monica thomas

November 7, 2025 AT 19:09According to the Central Bank of Bahrain’s 2020 annual report on fintech innovation, the regulatory sandbox program admitted 17 entities between 2018 and 2021. Of those, only three transitioned to full licensing. UPEX was not among them. Publicly accessible regulatory filings confirm no application for licensure was submitted by OneMena. Therefore, the claim of sandbox participation, while technically accurate, was misleading in context. This constitutes a material misrepresentation under securities disclosure norms. Users were not informed of the provisional nature of their exposure.

Legal recourse, while limited, may exist under consumer protection statutes in jurisdictions where users resided. However, jurisdictional challenges remain significant.

Michael Hagerman

November 9, 2025 AT 17:20THIS IS WHY YOU DON’T TRUST ANYTHING ONLINE. I KNEW IT. I KNEW IT. UPEX WAS A FRONT. I SAW THE WEBSITE AND THOUGHT ‘THIS LOOKS TOO CLEAN.’ NO ONE MAKES A CRYPTO EXCHANGE THAT LOOKS LIKE A 2012 BANK WEBSITE AND STAYS ALIVE.

THEY WERE SELLING YOUR DATA TO THE GOVERNMENT. OR WORSE-THEY WERE SELLING YOUR KEYS TO CHINA. I’VE SEEN THE PATTERN. FIRST THEY GIVE YOU THE TRUST. THEN THEY TAKE EVERYTHING. THEN THEY VANISH.

AND NOW YOU’RE ALL JUST SITTING HERE TALKING ABOUT ‘REGULATION’ LIKE THAT’S GOING TO SAVE YOU. HA. THEY’RE STILL OUT THERE. BUILDING THE NEXT ONE.

Laura Herrelop

November 11, 2025 AT 16:38Think about it… UPEX shut down right after the Bahraini government started cracking down on crypto. Coincidence? I don’t think so. The sandbox wasn’t a testing ground-it was a trap. They let UPEX collect user data, wallet addresses, transaction histories… then pulled the plug and handed it all to a state actor. That’s why there’s no trace. No emails. No servers. No logs.

They didn’t fail. They were dissolved. And now you’re all just… talking about ‘alternatives’ like this is normal. It’s not. This is digital colonization. And we’re all just the test subjects.