Bitcoin doesn’t sleep. Prices can swing 10% in an hour, and overnight, a $60,000 coin can drop to $54,000 without warning. If you’re holding Bitcoin and haven’t set a stop-loss, you’re gambling - not trading. A stop-loss isn’t about fear; it’s about control. It’s the automatic safety net that sells your Bitcoin when things go south, so you don’t have to stare at your screen at 3 a.m. hoping the market turns around.

What a Stop-Loss Actually Does

A stop-loss order is a pre-set instruction to sell your Bitcoin when the price hits a level you choose. You don’t need to be watching. When Bitcoin drops to your stop price, the exchange automatically triggers a sell. It turns into a market order, meaning it sells at the next available price. Simple. Reliable. Essential.

Let’s say you bought Bitcoin at $58,000. You set a stop-loss at $52,000. If Bitcoin crashes to $52,000 - even if it’s due to a sudden tweet or regulatory news - your position sells. You lose $6,000 per coin. That’s painful, but it’s better than watching it fall to $45,000 while you’re asleep.

There are two types:

- Standard stop-loss: Turns into a market order. Fast execution, but price may be worse than expected during crashes.

- Stop-limit order: Turns into a limit order. You set both a stop price and a limit price. It only sells if the price is at or above your limit. Safer, but it might not execute at all if the market plummets past your limit.

For most Bitcoin traders, especially beginners, a standard stop-loss works best. It ensures you get out. Limit orders are for experienced traders who understand slippage and market depth.

Where to Place Your Stop-Loss

Don’t pick a number out of thin air. Don’t set it 5% below your buy price just because someone online said so. That’s how you get shaken out during normal volatility.

Look at the chart. Find where Bitcoin has bounced before. These are called support levels. If Bitcoin kept rebounding from $55,000 over the last three weeks, that’s a strong support zone. Your stop-loss should go just below it - say, $54,800. Why? Because if Bitcoin breaks below $55,000, it’s likely heading lower. You’re not guessing. You’re following the market’s behavior.

Another method: use the Average True Range (ATR). This measures volatility. If Bitcoin’s 14-day ATR is $3,500, setting your stop-loss at 1.5x ATR ($5,250) below your entry gives it room to breathe without getting triggered by noise. For a $58,000 buy, that’s a stop at $52,750. This adjusts naturally as volatility changes.

Here’s a real example from last month: Bitcoin rose from $56,000 to $61,000. A trader set a stop-loss at $55,500 - just below the previous swing low. When Bitcoin dipped to $55,600, the stop didn’t trigger. Then it dropped to $55,300. The stop hit. The trader lost $700 per coin. But then Bitcoin surged back to $62,000. The trader missed the rally - but they protected their capital. They could re-enter later. That’s discipline.

How Much Risk Are You Willing to Take?

Never risk more than 1-2% of your total trading account on a single Bitcoin trade. That’s the golden rule. If you have $10,000 saved for crypto, your max loss on one trade should be $100-$200.

So how does that connect to stop-loss? It’s math.

You buy Bitcoin at $57,000. You’re willing to lose $150. Each Bitcoin you own is worth $57,000. How many coins can you buy with $150 of risk?

Let’s say you set your stop-loss at $55,000. That’s a $2,000 loss per coin. To lose only $150, you can only buy 0.075 BTC. That’s $4,275 worth of Bitcoin. You’re not risking $150 on $10,000 - you’re risking $150 on $4,275. That’s how position sizing works.

Most new traders buy too much and set stops too tight. They buy 0.2 BTC at $57,000 ($11,400) and set a stop at $56,500 - only $100 away. One 2% dip kills their position. They think they’re being careful. They’re not. They’re just getting stopped out too often.

Trailing Stops: Let Bitcoin Ride

What if Bitcoin goes up? A static stop-loss leaves money on the table. That’s where trailing stops come in.

A trailing stop follows the price as it rises. If you set a 7% trailing stop on Bitcoin bought at $50,000:

- Price goes to $55,000 → stop moves to $51,150

- Price goes to $60,000 → stop moves to $55,800

- Price drops to $55,700 → your order triggers and sells

You locked in $5,800 profit without lifting a finger. You didn’t guess the top. You didn’t panic. The market did it for you.

Exchanges like Binance and Gemini let you set trailing stops as a percentage or fixed dollar amount. Start with 5-8%. Too tight, and you get stopped out early. Too loose, and you give back too much. Test it. Track what works.

Common Mistakes (And How to Avoid Them)

Here’s what most beginners do wrong:

- Setting stops at round numbers: $50,000, $45,000. Everyone else is watching those levels. When Bitcoin hits $50,000, hundreds of stop-losses trigger at once. That creates a cascade. Your order gets filled at $48,500 instead of $50,000. Avoid round numbers. Use $49,800 or $50,200.

- Setting stops too tight: 2-3% below entry. Bitcoin moves 5% daily. You’ll get stopped out constantly. Use 5-10% for new positions.

- Not adjusting stops: If Bitcoin moves up 15%, your stop should move up too. Otherwise, you’re not protecting gains.

- Forgetting slippage: In fast crashes, your stop-loss might execute $1,000 or more below your trigger price. That’s normal. It’s the price of automation.

Pro tip: Watch the order book. If there’s a big wall of sell orders just below your stop level, move it lower. You don’t want to be the first one dumped into a liquidity vacuum.

When to Adjust Your Stop-Loss

Don’t set it and forget it. Adjust based on context:

- After a strong rally: Move your stop up to lock in profit. If Bitcoin jumped 12%, raise your stop to break-even or slightly below.

- Before major news: Fed rate decision? Bitcoin ETF approval? Volatility spikes. Tighten your stop to 1-3% if you’re risk-averse. Or widen it to 10% if you expect a breakout.

- During consolidation: If Bitcoin is stuck between $55,000-$57,000 for days, don’t set a tight stop. Price will wiggle. Use ATR or move your stop to the bottom of the range.

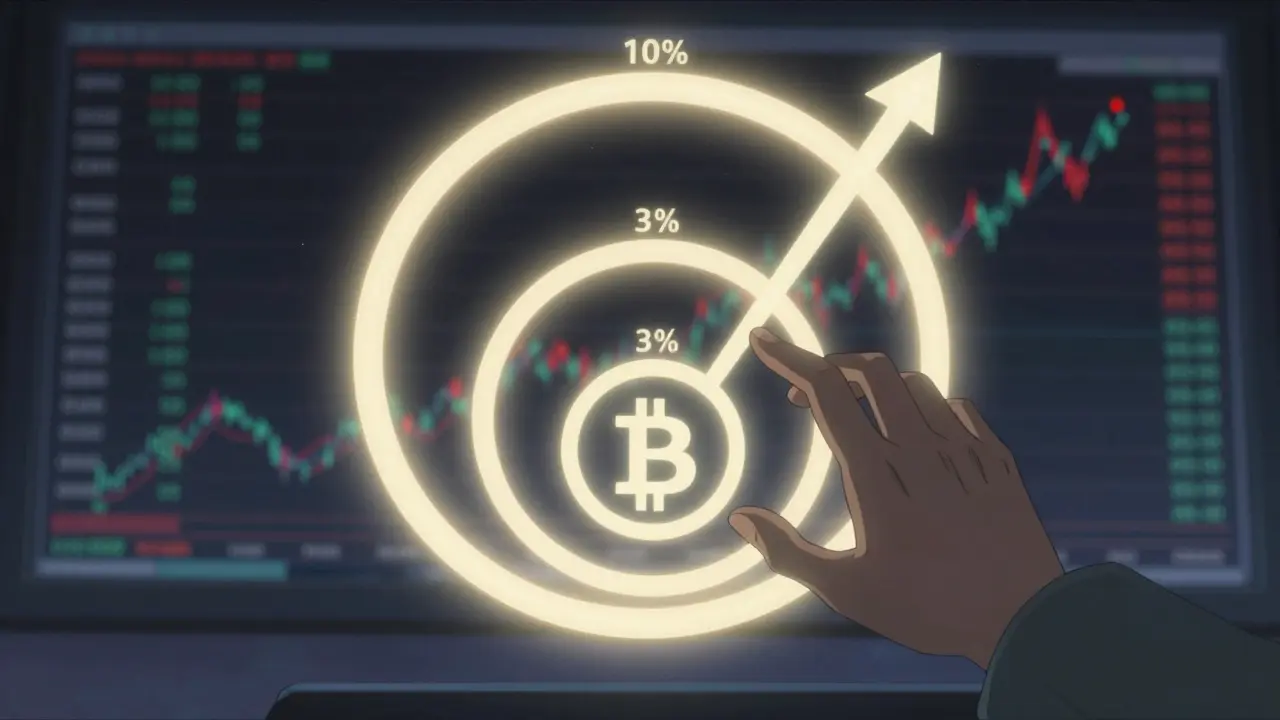

One trader I know sets three stop-losses on one position:

- 3% below entry: sells 25% of position

- 6% below entry: sells another 25%

- 10% below entry: sells the rest

This way, he doesn’t lose everything on one dip. He keeps some exposure alive. It’s not perfect, but it’s smarter than all-or-nothing.

Stop-Loss Isn’t a Crystal Ball

Some traders think stop-losses guarantee safety. They don’t. In extreme crashes - like the 2022 Terra collapse or the 2024 FTX fallout - prices gap down. Your stop-loss triggers at $48,000, but the next trade happens at $42,000. That’s slippage. It’s unavoidable.

That’s why you combine stop-losses with position sizing. Never risk more than 2% per trade. Even if you lose 10% on execution, your account only drops 0.2%. You survive.

Stop-losses are tools. Not magic. They work best when you use them with discipline, not emotion.

Final Checklist

Before you hit "submit" on your stop-loss order, ask:

- Is my stop below a real support level - not just a number I picked?

- Am I risking no more than 1-2% of my total account on this trade?

- Is my stop wide enough to survive normal Bitcoin swings (5-10%)?

- Have I considered slippage? Am I okay with getting filled below my trigger?

- Will I adjust this stop if Bitcoin moves up?

If you answered yes to all five, you’re ready.

Do all Bitcoin exchanges offer stop-loss orders?

Most major centralized exchanges like Binance, Coinbase, Gemini, and Bitstamp offer stop-loss orders. Some decentralized exchanges (DEXs) have limited or no native support. If you’re using a DEX like Uniswap, you’ll need to use third-party tools or smart contracts to simulate stop-losses - and those come with higher complexity and risk.

Can I set a stop-loss on my Bitcoin wallet?

No. Wallets like Ledger or MetaMask only store your Bitcoin. They don’t execute trades. You need to use a trading platform - a centralized exchange - to set a stop-loss. You can’t protect your Bitcoin in cold storage with a stop-loss. You protect your trading position on an exchange.

Should I use a stop-loss if I’m a long-term holder?

If you’re truly holding Bitcoin as a long-term store of value - not trading - then no. Stop-losses are for active traders. Long-term holders should focus on dollar-cost averaging and ignore short-term price swings. Setting a stop-loss on a buy-and-hold position can lead to selling at the bottom and missing the next bull run.

What’s better: percentage-based or ATR-based stop-loss?

ATR-based stops adapt to market volatility. If Bitcoin is calm, the stop is tight. If it’s wild, the stop widens. Percentage-based stops are simpler but don’t adjust. For Bitcoin, ATR is more effective. Start with 1.5x the 14-day ATR as your stop distance. It’s used by professional traders and works better in crypto’s wild swings.

Why does my stop-loss sometimes trigger but Bitcoin rebounds?

That’s called a "false breakout" or "stop hunt." Many traders set stops at obvious levels - like $50,000. When price hits that level, all those orders trigger, forcing a temporary drop. Then the market reverses. This is why you should place your stop below support, not at round numbers. Use technical analysis, not guesswork.

Vishakha Singh

February 20, 2026 AT 17:37Setting a stop-loss isn't just about protecting capital-it's about preserving your peace of mind. I've seen traders lose sleep over Bitcoin swings, only to realize later they could've walked away with 80% of their position intact. I started using ATR-based stops last year, and it changed everything. No more guessing. No more panic. Just discipline. If Bitcoin's 14-day ATR is $4,000, I set my stop at 1.5x that. It absorbs the noise. It lets the trend breathe. And when it triggers? I don't second-guess. I review. I adjust. I re-enter if the fundamentals still hold. This isn't fear. It's strategy.

Also, never set stops at round numbers. $50,000 is a magnet for stop hunts. Go for $49,750 or $50,200. Small shifts make big differences.

And yes-trailing stops are your best friend if you're holding for more than a week. Set it at 7%, walk away, and come back a week later. You'll be surprised how much you keep.

Discipline beats intuition every time.