There’s no verified information about an exchange called Excalibur. Not on official regulatory websites. Not on major crypto review platforms. Not even in the public blockchain records that track exchange activity. If you’ve seen ads, social media posts, or YouTube videos pushing Excalibur as the next big crypto trading platform, you’re being targeted by something that doesn’t exist - or worse, something designed to steal your money.

Why You Can’t Find Excalibur Crypto Exchange

Search for "Excalibur crypto exchange" on Google, CoinMarketCap, CoinGecko, or even the official websites of regulators like the ASIC in Australia or the SEC in the U.S. You won’t find a legitimate business listing. No registered company. No licensed trading platform. No public audit reports. No customer support email that responds. That’s not an oversight. That’s a red flag flashing in bright neon. Real crypto exchanges don’t hide. They publish their legal registration numbers. They list their headquarters. They link to their security certifications. Kraken, for example, is ISO/IEC 27001 certified. Binance has a public proof-of-reserves system. Even smaller, regulated platforms like Bitstamp show their financial statements and compliance reports. Excalibur shows nothing. And that’s the first rule of crypto safety: if you can’t verify it, don’t touch it.The Warning Signs of a Fake Exchange

Scammers love names like Excalibur. They pick grand, mythical names to sound powerful, trustworthy, and exclusive. They use fake testimonials, stock photos of smiling traders, and promises of 20% monthly returns. They’ll tell you it’s "limited-time only" or "for early adopters." They’ll push you to deposit quickly before the "offer expires." Here’s what they always do:- Ask you to send crypto to a wallet address they control - not a verified exchange deposit address.

- Use unregistered domains like excalibur-crypto[.]xyz or excaliburtrade[.]io - not .com or .org.

- Have no phone number, no physical address, and no customer service you can actually reach.

- Offer "24/7 support" but only through a chatbot that repeats the same lines.

- Require you to download a custom app from an unknown source - not Apple App Store or Google Play.

How Legitimate Exchanges Protect Your Funds

If you’re looking for a real crypto exchange, here’s what you should expect - and what Excalibur doesn’t offer:- Cold storage: At least 95% of user funds are kept offline in secure hardware wallets. Exchanges like Kraken store assets in geographically dispersed vaults with armed guards and biometric access.

- Multi-factor authentication (MFA): Every login requires more than a password. Google Authenticator, YubiKey, or SMS verification are standard.

- Regular audits: Reputable exchanges hire third-party firms like Grant Thornton or BDO to publish proof-of-reserves reports. These prove they have enough crypto to cover all user balances.

- Regulatory compliance: Legit exchanges are registered with financial authorities. In Australia, that’s ASIC. In the U.S., it’s FinCEN or state-level licenses.

- Transparent fee structure: No hidden charges. Withdrawal fees are listed clearly. Trading fees are tiered based on volume - not fixed at 5% for everyone.

What to Do Instead

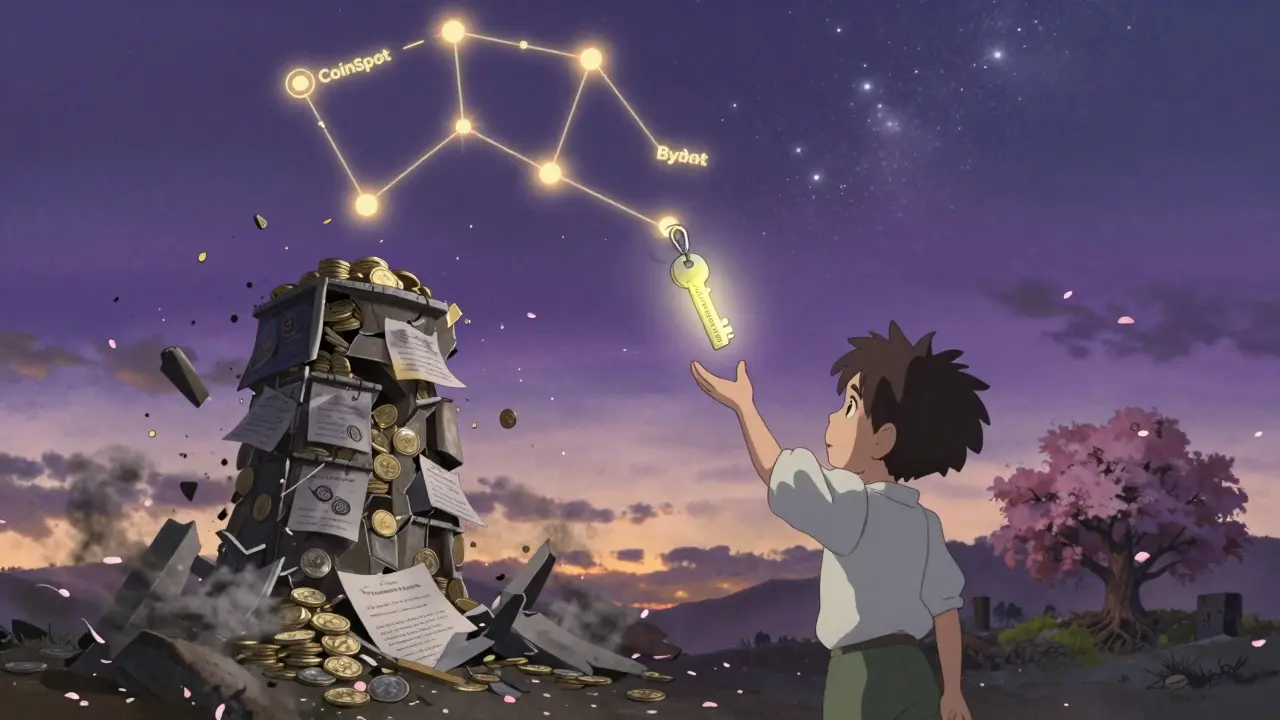

If you want to trade crypto safely, stick with platforms that have been around for years and have a public track record:- Kraken: Based in the U.S., ISO certified, supports 200+ cryptocurrencies, low fees for high-volume traders.

- Bybit: Popular in Asia and Australia, strong derivatives trading, clear fee schedule, two-factor authentication required.

- CoinSpot: Australian-based, ASIC-registered, easy for beginners, supports AUD deposits via bank transfer.

- Binance: Largest exchange globally, but check local regulations - it’s restricted in some countries including Australia for derivatives.

What Happens If You Deposit Into Excalibur

If you’ve already sent crypto to Excalibur, here’s what you’re facing:- Your funds are gone. There’s no way to reverse a crypto transaction.

- The platform will disappear within days or weeks. Their website will go offline. Their social media accounts will vanish.

- You won’t get your money back. Law enforcement rarely recovers funds from these scams - especially if the wallet address is overseas.

- You may be targeted again. Your email or phone number will be sold to other scammers who’ll offer you "recovery services" - for a fee, of course.

How to Spot Scams Before They Trap You

Before you sign up for any crypto exchange, ask yourself these three questions:- Can I find the company’s legal registration number on a government website?

- Does the exchange publish proof-of-reserves or third-party audit reports?

- Is the domain name legitimate? (Check for misspellings, unusual TLDs like .xyz, .io, .app)

Crypto is risky enough without adding fake exchanges into the mix. Stick to the ones that are transparent, regulated, and have been tested by millions of users over years. Don’t gamble your savings on a name that doesn’t exist.

Is Excalibur Crypto Exchange real?

No, Excalibur Crypto Exchange is not real. There is no verified company, regulatory registration, or public audit record for this platform. It does not appear on any official crypto exchange lists, including CoinMarketCap, CoinGecko, or ASIC’s registry. It is likely a scam.

Why can’t I find Excalibur on Google or CoinMarketCap?

Legitimate crypto exchanges are listed on major platforms like CoinMarketCap and CoinGecko. If Excalibur isn’t there, it’s because it doesn’t meet the basic criteria for inclusion - like having a registered business, public trading volume, or verified security practices. Its absence is a clear warning sign.

What should I do if I already sent crypto to Excalibur?

If you sent crypto to Excalibur, your funds are almost certainly lost. Crypto transactions are irreversible. Report the scam to your local financial regulator (like ASIC in Australia) and your bank if you used a debit or credit card. Do not pay anyone who claims they can recover your funds - that’s a second scam.

How do I know if a crypto exchange is safe?

Check if the exchange is regulated by a known authority like ASIC, FINCEN, or the FCA. Look for proof-of-reserves reports, cold storage disclosures, and multi-factor authentication. Avoid platforms that pressure you to deposit quickly or use unofficial apps. Stick to well-known exchanges with years of public history.

Are there any crypto exchanges in Australia I can trust?

Yes. CoinSpot, Kraken, and Bybit are all accessible to Australian users. CoinSpot is registered with ASIC and allows AUD deposits via bank transfer. Kraken is globally regulated and offers strong security. Always verify the domain name and check for official regulatory status before depositing.

Michael Sullivan

February 2, 2026 AT 17:25Excalibur? More like Excali-SCAM. 🤡 I saw a YouTube ad for it yesterday - glowing testimonials, a guy in a suit holding a sword made of Bitcoin. Bro, that’s not a platform, that’s a Disney villain’s LinkedIn page.