Mining Profitability Calculator 2025

Mining Setup

Hardware Information

Select a coin to see hardware requirements and performance metrics.

Results

Select a coin and enter electricity cost to see results

Click the Calculate button to begin

Trying to decide whether to pour money into a Bitcoin mining rig or dip your toes into the world of altcoins? In 2025 the choice isn’t just about which coin looks cooler - it’s a full‑blown cost‑benefit puzzle involving hardware, electricity, market dynamics, and even geography. Below we break down the key factors so you can see which path lines up with your budget, skill set, and profit goals.

What is Bitcoin mining the process of securing the Bitcoin network by solving cryptographic puzzles with specialized hardware, earning newly minted BTC as a reward and How It Works

Bitcoin mining relies exclusively on Application‑Specific Integrated Circuits (ASICs). These chips are built to compute the SHA‑256 hash function at blistering speeds. When a miner finds a hash below the network’s target, they broadcast the solution, add a new block, and collect the block reward. After the fourth halving in April 2024, the reward sits at 3.125 BTC, which translates to roughly $175,000 at today’s price of $56,000 per BTC. The reward is cut in half roughly every four years, so the pressure to stay efficient only grows.

The network’s hash rate - the total computational power competing for each block - is now at an all‑time high, exceeding 350 EH/s (exahashes per second). More hash power means tougher puzzles, which in turn forces miners to upgrade hardware or risk being left behind.

Understanding Altcoin mining the extraction of cryptocurrencies other than Bitcoin using various consensus mechanisms and hardware types in 2025

Altcoins cover a wide spectrum of PoW (Proof‑of‑Work) coins that still reward miners. Unlike Bitcoin, many of these coins can be mined with consumer‑grade GPUs or even CPUs, lowering the entry barrier. Popular choices include:

- Litecoin a Bitcoin‑fork that uses the Scrypt algorithm, offering 2.5‑minute block times and a 6.25 LTC reward

- Monero a privacy‑focused coin that deliberately resists ASICs, allowing CPU and GPU mining

- Ethereum Classic the original Ethereum chain that kept PoW after the main Ethereum shift to Proof‑of‑Stake

These coins often have faster block times (Litecoin 2.5 min, Monero ~2 min) and lower difficulty levels, which can translate to quicker payouts for small operators.

Profitability Comparison: Numbers That Matter

Let’s cut through the hype with a side‑by‑side snapshot of the most relevant metrics for a typical 2025 setup. Figures are averages based on September‑2025 market data, electricity rates of $0.06/kWh for industrial‑scale Bitcoin farms and $0.09/kWh for hobbyist altcoin rigs.

| Coin | Block Time | Reward per Block | Typical Hardware | Avg Daily Net Profit* |

|---|---|---|---|---|

| Bitcoin | 10 min | 3.125 BTC | Whatsminer M30S++ (112 TH/s) | $12 |

| Litecoin | 2.5 min | 6.25 LTC | Goldshell LT6 (2.8 TH/s) | $5 |

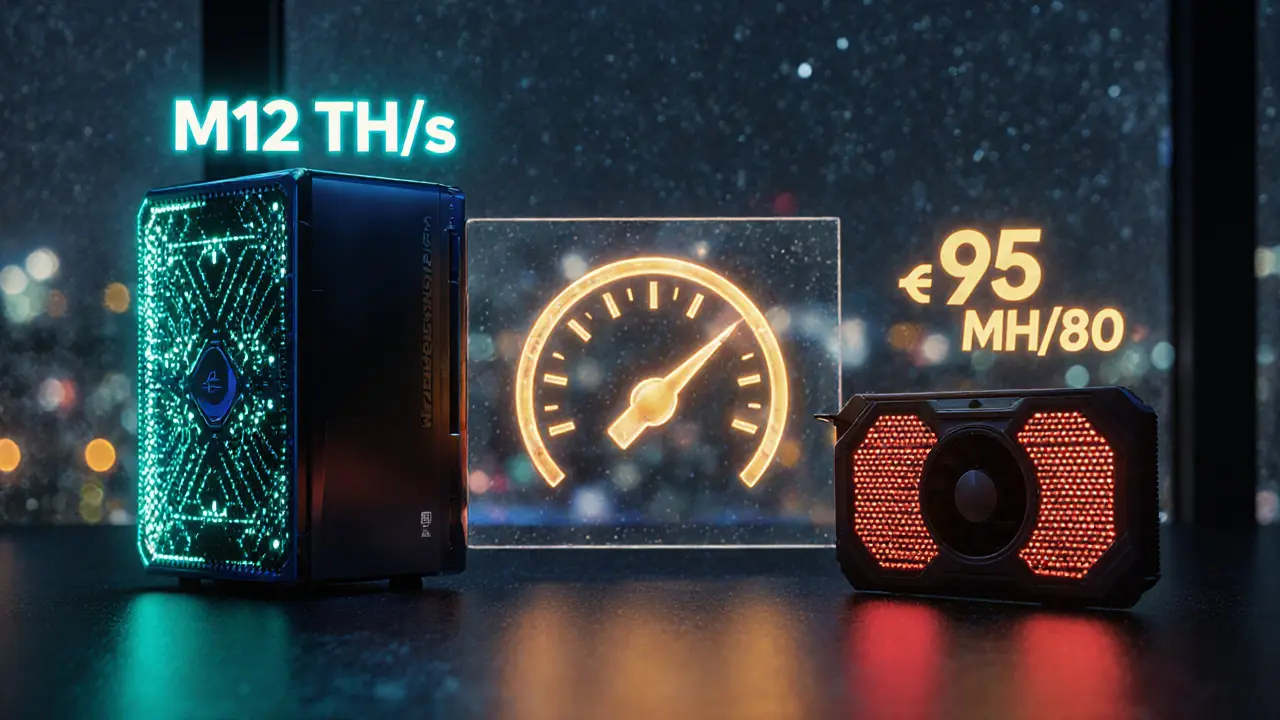

| Monero | 2 min | ≈2.15 XMR | RTX 3080 GPU (≈95 MH/s) | $3.8 |

| Ethereum Classic | 13 sec | ≈3.2 ETC | RTX 3070 GPU (≈62 MH/s) | $2.5 |

*Net profit assumes 24‑hour operation, average difficulty, and the electricity cost noted above. Maintenance, pool fees, and ASIC depreciation are not included.

From the table you can see that Bitcoin still offers the highest absolute daily earnings per unit of hardware, but the margin is razor‑thin and heavily dependent on cheap power. Altcoins deliver better ROI for hobbyists because the upfront cost is lower and the break‑even point can be reached in weeks rather than months.

Hardware Choices: ASIC specialized mining chips optimized for a single hashing algorithm vs GPU graphics processing units that can run parallel hash calculations for many PoW algorithms vs CPU central processing units capable of mining privacy‑centric coins like Monero

ASICs dominate Bitcoin mining because they deliver terahashes per second at a fraction of the energy cost of GPUs. A modern ASIC like the Whatsminer M30S++ can push 112 TH/s while sipping about 3,400 W. The downside? Massive upfront spend (often $8,000‑$12,000 per unit) and no flexibility - the chip can only mine SHA‑256.

GPUs shine when mining Scrypt, Ethash, RandomX, and other algorithms. A single RTX 3080 can churn out roughly 95 MH/s on RandomX (Monero) for $1,200, and you can reuse the card for gaming or AI workloads later. GPUs also let you switch between coins as profitability shifts.

CPUs are viable for RandomX, the algorithm Monero uses to stay ASIC‑resistant. Even an old i7 can make a few dollars a day, making it the cheapest way to test the waters.

Bottom line: if you have deep pockets and cheap electricity, ASICs give you the best chance at sustained Bitcoin profit. If you’re budget‑conscious or want flexibility, start with a GPU rig and add CPUs for privacy‑coins.

Operational Costs: Electricity the primary ongoing expense for any PoW mining operation, Mining pools collaborative groups that combine hash power to earn more consistent rewards, and Location geographic factors influencing power costs, climate, and regulatory environment

Energy bills can make or break a venture. In 2025 the most competitive Bitcoin farms secure rates under $0.05/kWh, often through long‑term contracts with hydroelectric plants in Iceland or surplus coal power in Kazakhstan. For hobbyists, residential rates hover around $0.12/kWh in the U.S., which erodes most Bitcoin ASIC profitability within weeks.

Mining pools spread the variance of block rewards. Joining a pool like AntPool for Bitcoin or LitecoinPool.org for LTC gives you daily payouts proportional to contributed hash power, smoothing cash flow.

Location matters beyond electricity. Cooler climates reduce cooling costs. Regulations vary; some countries have banned PoW outright, while others offer tax incentives. Always check local laws before setting up hardware.

Risk Factors and Future Outlook

Every mining decision carries risks:

- Price volatility: A 30% dip in Bitcoin’s price can wipe out weeks of profit for an ASIC farm.

- Difficulty spikes: After a halving, the network typically sees a difficulty increase as new miners join, squeezing margins.

- Regulatory pressure: Some jurisdictions are tightening emissions reporting, which could raise compliance costs.

- Technology obsolescence: New ASIC generations appear roughly every 12‑18 months, making older models less competitive.

For altcoins, the biggest threat is protocol migration. Ethereum’s move to Proof‑of‑Stake eliminated mining entirely; while Monero and Litecoin have pledged to stay PoW, community votes could change that landscape.

Looking ahead to 2026, expect Bitcoin mining to remain a game for well‑capitalized players with access to sub‑$0.05 electricity. Altcoin mining will stay attractive to hobbyists, especially if they can pivot quickly when a coin’s difficulty spikes or when new privacy‑coin projects launch.

Getting Started: Practical Checklist

- Define your budget and power cost. Calculate expected kWh usage for your chosen hardware.

- Pick a coin that matches your hardware: ASIC for Bitcoin, GPU for Litecoin/ETC, CPU/GPU for Monero.

- Join a reputable mining pool. Note the pool fee (usually 1‑2%).

- Set up proper cooling and ventilation. Hot rigs lose efficiency fast.

- Configure mining software (e.g., CGMiner for ASICs, XMRig for Monero, NiceHash for flexible GPU mining).

- Monitor profitability daily using tools like WhatToMine or NiceHash profitability calculator.

- Keep an eye on regulatory news in your region and be ready to adjust or relocate.

Follow these steps, stay disciplined about costs, and you’ll know whether Bitcoin’s heavyweight grind or altcoin’s lighter sprint fits your goals.

Frequently Asked Questions

Is Bitcoin mining still profitable in 2025?

Profitability hinges on electricity cost and hardware efficiency. With power under $0.05/kWh and a modern ASIC like the M30S++, you can break even in 6‑8 months. Above $0.08/kWh, most small operators see losses.

Can I mine Bitcoin with a GPU?

No. Bitcoin’s SHA‑256 algorithm is ASIC‑only. GPUs are orders of magnitude slower and cannot compete with dedicated ASIC farms.

Which altcoin offers the fastest return on investment?

Litecoin often provides the quickest ROI for a modest ASIC investment because its block time is 2.5 minutes and the hardware cost is roughly $3,000 for a Goldshell LT6.

Do I need a cooling system for a GPU mining rig?

Yes. GPUs generate 150‑300 W each and can quickly overheat. At least one dedicated fan or a small airflow setup is essential for stable operation.

How does a mining pool affect my earnings?

Pools smooth out earnings by distributing rewards proportionally to contributed hash power. You’ll earn small, frequent payouts instead of waiting for a rare solo block, but expect a 1‑2% fee.

Marina Campenni

October 14, 2025 AT 01:10I understand the dilemma of picking between Bitcoin and altcoin rigs, and I hope this guide helps you decide.

Irish Mae Lariosa

October 16, 2025 AT 23:26The article provides a solid foundation for newcomers to mining, but its scope is occasionally too broad.

It lumps together hardware considerations that, in practice, demand separate financial analyses.

For instance, the electricity cost assumptions ignore regional tariff structures that can vary dramatically.

Moreover, the comparison of daily net profit fails to factor in depreciation of ASICs over their typical lifecycle.

While the table lists a $12 daily profit for Bitcoin, it does not account for the upfront capital outlay of $10,000 per unit.

This omission can mislead readers into underestimating the break-even horizon.

The section on altcoin mining rightly highlights GPU flexibility, yet it glosses over the volatility of coin values that directly affect ROI.

Monero’s price swings, for example, can erode the modest $3.8 daily profit within weeks.

Additionally, the guide does not discuss the impact of mining pool fees beyond a generic 1‑2% range.

Larger pools often impose higher fees that disproportionately affect small operators.

The risk factors list mentions regulatory pressure but does not elaborate on specific jurisdictions that have banned PoW outright.

Prospective miners in the United States should be aware of state‑level electricity rebates that could improve margins.

The troubleshooting checklist is a useful addition, yet it omits the importance of monitoring hardware temperatures in real time.

Overheating can reduce efficiency by up to 15%, a factor that should be incorporated into profitability models.

In sum, the guide is informative, but readers would benefit from deeper quantitative analysis and region‑specific data.

Nick O'Connor

October 19, 2025 AT 22:16Thanks for the thorough breakdown, Nick, I see where the long‑winded sections could use a tighter focus, especially regarding the electricity cost assumptions, and I appreciate the reminder about depreciation, which is often overlooked.

Sara Stewart

October 22, 2025 AT 18:20Great rundown! For anyone chasing ROI, the hash‑rate differential between ASICs and GPUs is the keystone, and the guide nails that point.

ASIC‑only mining delivers unmatched efficiency, but the capital OPEX ratio can cripple hobbyists.

GPUs, on the other hand, let you pivot between Scrypt, RandomX, and Ethash without replacing hardware, which is essential in a volatile market.

Don’t forget that pool fees, usually 1‑2%, will shave off that glossy profit margin.

Overall, the guide equips both whales and minnows with the intel they need.

Laura Hoch

October 25, 2025 AT 17:10Your enthusiasm for the hardware trade‑offs is contagious, and I admire how you break down the jargon for newcomers.

While the ASIC advantage is undeniable, the flexibility of a GPU rig aligns better with a diversified portfolio, especially when coin difficulty spikes.

It’s also worth noting that power‑to‑hash efficiency isn’t the sole metric; long‑term sustainability encompasses cooling and resale value.

I appreciate your aggressive stance on staying ahead of the curve, and I echo the sentiment that informed experimentation drives the community forward.

Hailey M.

October 28, 2025 AT 15:00Oh wow, another masterclass on mining profits – because what the world really needed was more tables of numbers 🙄💸.

I mean, who wouldn’t want to spend weeks calibrating a rig just to earn a few bucks while the market does a roller‑coaster?

*Insert dramatic eye roll here.*

At least the guide tells us that electricity costs are the real villain, so we can all blame the utility company for our broken dreams.

Thanks for the existential crisis, really brightened my day! 😂

Schuyler Whetstone

October 31, 2025 AT 13:50Hailey, youre missing the point about responsibility – mining isnt just a hobby its a contribution to decentralisation and youre acting like it a game.

People should think about the environmental impact before bragging about profit tables.

This lazy attitude is what fuels the narrative that crypto is a scam, and its just not ok.

Pierce O'Donnell

November 3, 2025 AT 12:40Honestly, the whole ASIC hype is overblown; GPUs will outpace them once the next halving hits.

Bobby Lind

November 6, 2025 AT 11:30Wow, that’s a bold claim, and I love the confidence, but let’s remember that market dynamics are complex, and while GPU tech is advancing fast, ASICs still dominate hash power, so both have a place, right?!

Deepak Kumar

November 9, 2025 AT 10:20Don’t let the numbers scare you-if you have access to cheap power and can invest in a solid ASIC, you’re already ahead of the curve.

Start small, track your efficiency daily, and scale up when you see consistent returns.

Remember, the mining community thrives on shared knowledge, so ask for help whenever you hit a snag.

Your dedication will pay off when the hash rate stabilizes and electricity costs stay low.

Keep pushing, the rewards are within reach!

Miguel Terán

November 12, 2025 AT 09:10Your encouragement is truly uplifting and I think many newcomers will find solace in your words because mining can feel like a solitary endeavor especially when the initial setup seems daunting.

It is important to remember that the learning curve is steep but not insurmountable as you monitor power usage and adjust pool selections you will gradually build confidence.

Over time the data you collect becomes a roadmap for optimization and the community benefits from shared experiences so keep documenting your progress.

Shivani Chauhan

November 15, 2025 AT 08:00Thank you for the comprehensive overview.

The guide successfully balances technical depth with practical advice, making it suitable for both seasoned operators and novices alike.

I would, however, suggest adding a section on the legal considerations in jurisdictions where PoW mining faces regulatory scrutiny, as this is increasingly pertinent.

Additionally, including a comparative analysis of cooling solutions could further enhance the utility of the document.

Overall, the presentation is clear, well‑structured, and highly informative.

Deborah de Beurs

November 18, 2025 AT 06:50Look, Shivani, while your polite tone is nice, you’re glossing over the fact that many regions are about to shut down PoW mining altogether – and that’s a reality people need to face now, not later.

The guide should scream this warning from the rooftops instead of tucking it in a footnote.

Stop sugar‑coating the risk!

Vinoth Raja

November 21, 2025 AT 05:40It’s fascinating how the mining ecosystem mirrors natural selection – only the most efficient hardware survives, yet the environment – in this case regulation and energy availability – shapes evolution just as much as raw hash power.

Understanding this balance helps us anticipate where the next profitable opportunities will arise.

Kaitlyn Zimmerman

November 24, 2025 AT 04:30Vinoth, that's a great perspective and I think emphasizing the regulatory landscape alongside hardware efficiency can help newcomers make smarter choices.

Providing resources on local energy policies and safe cooling practices would be a valuable addition to the guide.