Businesses aren’t just testing distributed ledger technology anymore-they’re using it to cut costs, stop fraud, and move faster than ever. By 2026, over 83% of Fortune 500 companies have active DLT projects running, and it’s not because of hype. It’s because the numbers add up. A single shared ledger that updates in real time, eliminates manual reconciliation, and locks data in place with cryptography is changing how companies track everything from shipments to stock trades.

One Source of Truth, No More Reconciliation

Think about how many times your finance team has spent days chasing down discrepancies between bank statements, supplier invoices, and internal records. In traditional systems, every department has its own version of the truth. DLT fixes that. Instead of five different spreadsheets, you have one digital ledger that everyone in the network sees and updates at the same time. When a shipment clears customs, the update shows up instantly for the warehouse, the buyer, the bank, and the customs broker. No more emails. No more phone calls. No more mismatched numbers. This isn’t theory. IBM Food Trust cut the time it takes to trace a mango’s journey from farm to store from seven days to 2.2 seconds. That’s not a marketing slogan-it’s what happens when every step is recorded on a shared, tamper-proof ledger. For businesses, that means faster recalls, fewer losses, and more trust from customers.Speeding Up Payments and Settlements

Traditional cross-border payments can take three to five days. Why? Because they pass through multiple banks, clearinghouses, and intermediaries, each with their own processing windows. DLT removes those middlemen. Transactions settle in seconds or minutes, not days. In capital markets, the Global Financial Markets Association found that DLT reduces settlement times from T+2 or T+3 to near-instant. That frees up billions in working capital that would otherwise be tied up waiting for transfers to clear. Safeheron’s payment systems now handle cross-border invoices with automated settlement, cutting processing costs by up to 40%. For a company shipping goods to 20 countries, that’s not a small saving-it’s a competitive edge.Stopping Fraud Before It Starts

Fraud isn’t just about stolen credit cards. It’s fake invoices, counterfeit parts, forged certifications, and manipulated records. DLT makes all of that harder. In aerospace, Boeing and Lockheed Martin are part of the Aerospace and Defense Distributed Ledger Consortium (ADDC). They’re using DLT to track every part-from raw materials to final assembly. Each component gets a digital ID that records its origin, maintenance history, and certification status. If a part is counterfeit, the system knows immediately. No more guessing. No more recalls because someone didn’t check the paperwork. Accenture saw a 67% drop in data breaches after moving employee records to a blockchain-based system. Why? Because access is controlled by permissioned nodes. No single person can alter records without approval from others. That’s not just security-it’s accountability.

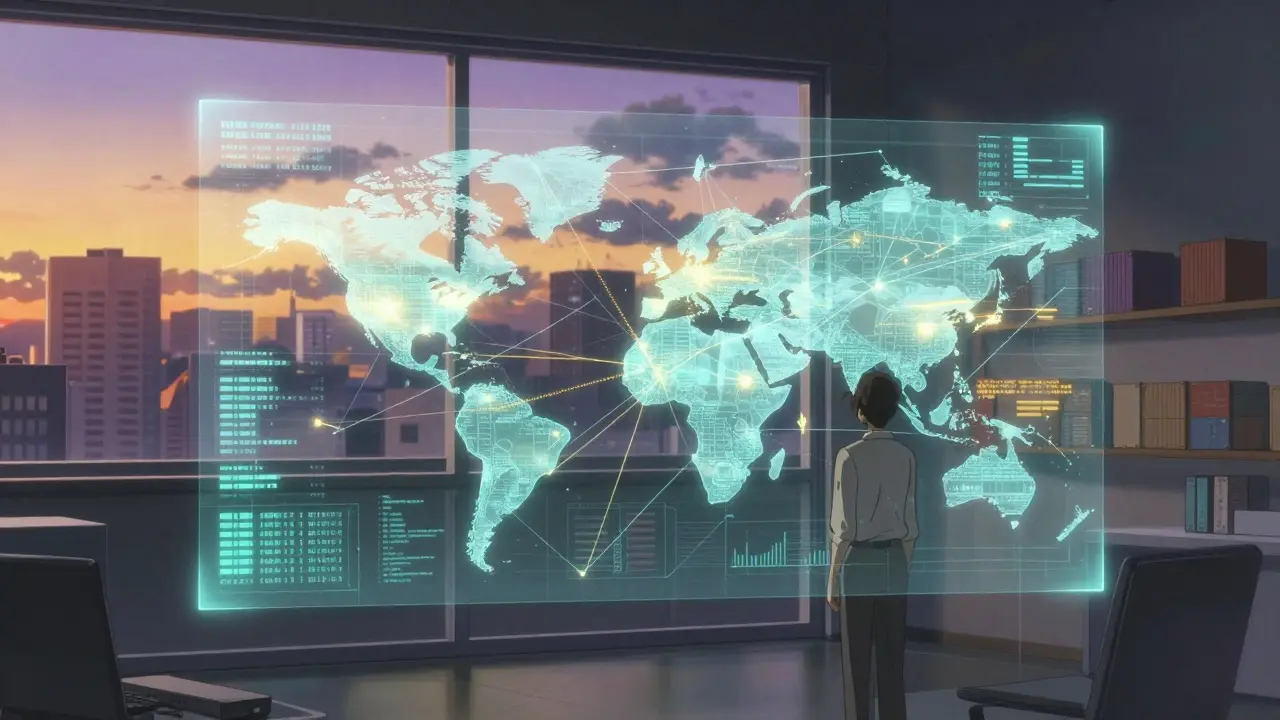

Supply Chains That Don’t Lie

Customers care where things come from. They want to know if their coffee is fair trade, if their clothes were made ethically, if their medicine is real. DLT gives them proof. Unilever reported a 22% increase in customer trust after launching transparent supply chain tracking using DLT. Shoppers can scan a QR code on a product and see the full journey: farm, factory, ship, warehouse, store. No marketing spin. Just facts, locked in place. For manufacturers, it’s not just about reputation-it’s about compliance. The EU’s MiCA regulations now require traceability for certain products. DLT isn’t optional anymore; it’s a legal requirement in many markets.Cost Savings You Can Count On

The biggest driver of DLT adoption isn’t technology-it’s money. Dr. Jane Smith, CTO at the Global Financial Innovation Institute, says DLT implementations in capital markets have cut operational costs by 30% to 50%. How? Through straight-through processing. No manual entry. No reconciliation teams. No paper trails. A European bank tried to build a DLT trade finance platform in 2023 and abandoned it after integration costs blew past projections by 180%. But that failure wasn’t because DLT doesn’t work-it was because they tried to rebuild everything at once. The winners are the ones who start small. IBM’s guide shows that basic payment integrations can go live in 4 to 6 weeks using existing APIs. You don’t need to overhaul your ERP system. Start with one process-like invoice matching or supplier onboarding-and scale from there.Who’s Using It-and Who Isn’t

Adoption isn’t even across industries. Financial services lead the pack, with 68% of major institutions using DLT in some form, according to Deloitte’s 2025 survey. Supply chain and logistics follow at 42%. Healthcare is catching up at 28%, mostly for managing patient records and drug provenance. Small businesses are slower to adopt. IDC found that companies with over 10,000 employees implement DLT 3.2 times faster than smaller ones. Why? Because they have the resources to invest in integration and compliance. But that’s changing. Cloud-based platforms like IBM Blockchain and R3 Corda now offer plug-and-play solutions that don’t require a team of blockchain engineers. The market is growing fast. From $4.9 billion in 2023, enterprise DLT spending is projected to hit $12.7 billion by 2026. The big players-IBM, R3, Hyperledger Fabric-control 58% of the market. Ethereum-based solutions are growing fast too, especially for smart contracts in finance and legal.

What DLT Can’t Do (And When to Walk Away)

DLT isn’t magic. It doesn’t solve every problem. Professor Michael Chen from MIT warns: “Don’t use blockchain because it’s trendy. Use it when you need trust, transparency, and multi-party coordination.” If your business only has one internal system, or if you’re processing millions of transactions per second like a stock exchange, DLT might be overkill. Traditional databases are still faster and cheaper for those cases. Energy use is another concern. Bitcoin-style proof-of-work systems are power-hungry. But enterprise DLT platforms like Hyperledger Fabric and R3 Corda use proof-of-authority or practical Byzantine fault tolerance-methods that consume a fraction of the energy. If sustainability matters to your brand, choose the right platform.Where to Start in 2026

If you’re thinking about DLT, don’t try to boil the ocean. Pick one pain point:- Are invoices taking weeks to settle? Try automated payment reconciliation with DLT.

- Are you losing money to counterfeit parts? Implement digital provenance tracking.

- Do customers ask where your products come from? Launch a transparency portal.

Freddy Wiryadi

January 27, 2026 AT 09:03