Crypto Token Health Checker

WeeCoins Health Assessment

This tool helps you determine if a crypto token like WeeCoins (WCS) might be "dead" based on key metrics described in our article. It uses criteria from our verification checklist to assess token viability.

Token Health Status

Verification Checklist

Ever stumbled on a coin called WeeCoins (WCS) and wondered what it actually is? You’re not alone. Most people see the ticker, a green‑leaning logo, and a promise of ‘eco‑friendly payments’ and assume the project is thriving. The truth is far more nuanced, and by the end of this guide you’ll know exactly how WeeCoins fits (or doesn’t) into today’s crypto landscape.

What is WeeCoins (WCS)?

WeeCoins (WCS) is an Ethereum‑based crypto token launched on February 28, 2021. The founders-self‑described environmental advocates and blockchain enthusiasts-positioned it as a medium of exchange for eco‑focused e‑commerce. In theory, users could earn or spend WCS on the Weesale platform, buying sustainable products while the token’s ‘stacking’ feature supposedly rewarded green actions.

Technical Foundations

The token lives on the Ethereum blockchain, leveraging its smart‑contract capabilities. While sources never explicitly name the token standard, it operates like an ERC‑20 asset-fungible, non‑minable, and compatible with any Ethereum wallet. Key technical attributes include:

- Total supply: 450,000,000 WCS

- Max supply: 450,000,000 (fixed)

- Mineable: No (purely token distribution)

- Stacking: Claimed feature, but implementation details are vague

Because it’s an ERC‑20‑like token, integration with DeFi protocols or exchanges is technically possible, yet real‑world adoption depends on community interest and liquidity-both of which are currently missing.

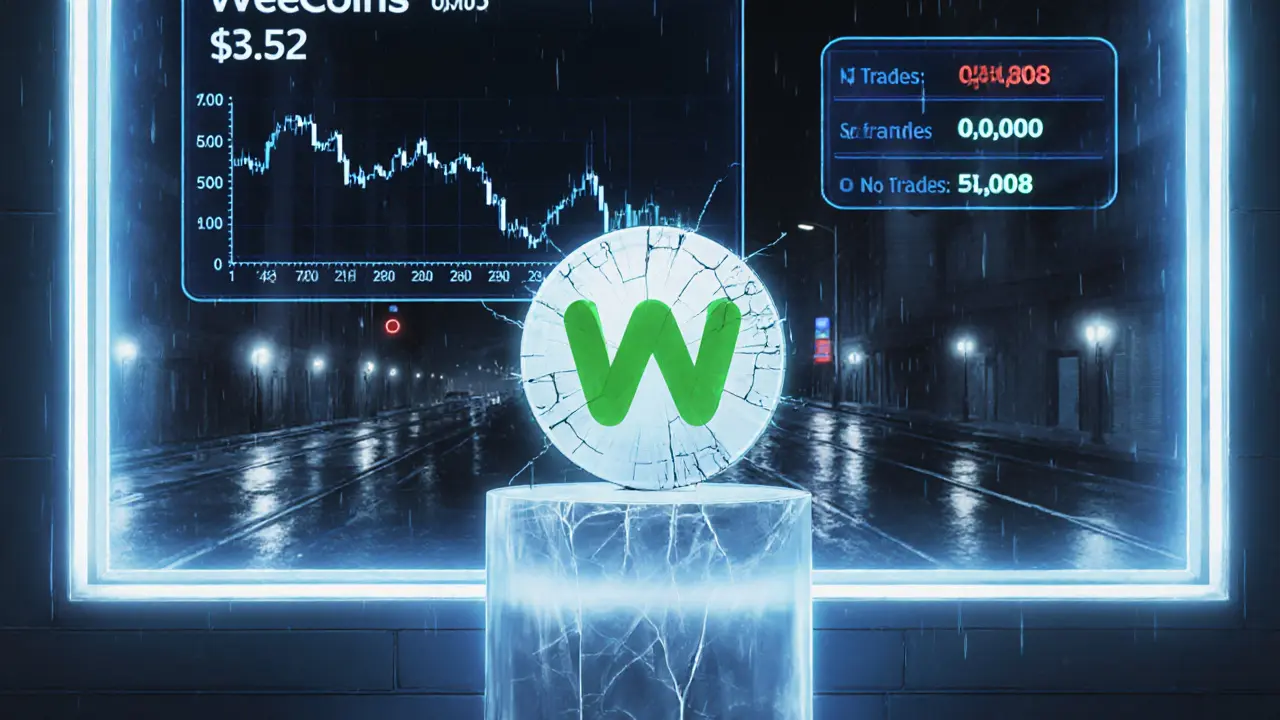

Economic Snapshot (2025)

Market data paints a bleak picture. Across tracking sites, the token’s price hovers around $0.0028, with a 24‑hour range of $0.00275‑$0.00285. The most striking figures are:

- All‑time high: $3.52 (July282021)

- Current market cap: ≈ $775K (CoinLore) - other sites report $0 due to zero circulating supply

- 24‑hour trading volume: as low as $9 (CoinLore) to $7,150 (CoinStats); overall negligible

- Circulating supply: reported as 0 on most platforms, indicating distribution failure

These numbers translate into a price decline of over 99% from its peak and a near‑complete freeze in trading activity-the last recorded trade was on March162022.

Why the Token Appears ‘Dead’

Several red flags explain the dormancy:

- Distribution Issues: A total supply of 450M exists, but virtually none is publicly circulating. Without tokens in users’ wallets, exchanges have nothing to list.

- Lack of Community: No Reddit threads, Telegram groups, or social media chatter. An active community is essential for price discovery and project momentum.

- Unfulfilled Roadmap: Early promises of faster transactions, educational programs, and e‑commerce partnerships never materialized.

- Low Liquidity: Trading volume under $10 signals that even if you wanted to buy or sell, you’d struggle to find a counterparty.

- Possible Pump‑and‑Dump: The rapid rise to $3.52 followed by a 99% crash within months mirrors classic pump‑and‑dump patterns in micro‑cap tokens.

Combined, these factors make WeeCoins a textbook example of a “dead coin” in the cryptocurrency ecosystem.

Comparing WeeCoins to a Typical Micro‑Cap Token

| Metric | WeeCoins (WCS) | Average Micro‑Cap |

|---|---|---|

| Launch Year | 2021 | 2020‑2024 |

| Total Supply | 450M | 10‑500M |

| Circulating Supply | 0 (reported) | 5‑300M |

| All‑Time High | $3.52 | $0.05‑$5.00 |

| Current Price | $0.0028 | $0.001‑$0.10 |

| 24‑h Volume | $9‑$7,150 | $10K‑$200K |

| Market Cap | ≈ $775K | $0.5‑$5M |

The table shows that while WeeCoins shares typical micro‑cap traits-low price, modest supply-it falls dramatically short on liquidity and community engagement.

Risks of Buying or Holding WeeCoins

If you’re thinking about buying WCS today, consider these risks:

- Liquidity Risk: Minimal volume means you may not be able to exit your position without a huge price impact.

- Regulatory Uncertainty: Tokens with unclear distribution can attract scrutiny from regulators focusing on securities law.

- Technical Stagnation: No development updates since 2022; any future upgrades are speculative at best.

- Price Volatility: With near‑zero activity, even a single large trade can swing the price wildly.

Given these factors, WeeCoins is generally considered a high‑risk, low‑potential asset-essentially a collector’s item for crypto history rather than an investment.

Future Outlook

Current data suggests the project is dormant. Industry research (Deloitte Crypto Market Report 2025) shows that tokens with zero trading activity for over two years have a 99.8% chance of permanent exit. Unless the original team resurrects the token, publishes a clear distribution plan, and re‑engages a community, WeeCoins will likely stay on the “dead coin” list.

That said, the ERC‑20 framework means the contract could be repurposed by a new team-though such a takeover would require community trust, which is currently absent. For most investors, the practical advice is to avoid WCS and focus on more active, transparent projects.

How to Verify a Token’s Health (Quick Checklist)

- Check the last trade date on multiple trackers.

- Confirm circulating supply vs. total supply.

- Search for active community channels (Telegram, Discord, Reddit).

- Review recent development commits on GitHub or similar.

- Assess liquidity: 24‑hour volume should be at least 0.5% of market cap.

Applying this checklist to WeeCoins quickly reveals red flags across every item.

Frequently Asked Questions

What does WCS stand for?

WCS is the ticker symbol for WeeCoins, the eco‑focused crypto token launched in 2021.

Is WeeCoins an ERC‑20 token?

While the official docs never label it, the token behaves like an ERC‑20 asset on the Ethereum blockchain, making it compatible with standard wallets.

Can I still buy WeeCoins on any exchange?

Only a handful of minor exchanges list WCS, and the daily volume is under $10, so buying is possible but highly illiquid and risky.

Why does the circulating supply show as zero?

All reported wallets hold no WCS, suggesting the token distribution never left the project’s reserve, a sign of a failed launch.

Is WeeCoins environmentally friendly?

The token’s concept targeted eco‑friendly purchases, but the project never delivered a working platform, so the environmental claim remains unproven.

What happened to the Weesale platform?

Weesale was supposed to let users redeem WCS for sustainable goods. As of 2025, the site is offline and there are no active user reports, indicating abandonment.

Should I consider WeeCoins for a long‑term portfolio?

Given zero liquidity, no community, and an inactive roadmap, WeeCoins is unsuitable for long‑term holding. Look for assets with transparent distribution and active development.

Teagan Beck

July 20, 2025 AT 15:38WeeCoins' lack of liquidity is the clearest red flag for anyone looking at a token with zero daily volume. Without active traders, even a small sell order would crush the price, making the token practically unsellable. It's a classic case where the token exists on paper but not in users' wallets.

Shrey Mishra

July 30, 2025 AT 13:14One might argue that the token's intention was noble, yet the stark reality paints a picture of ambition abandoned mid‑flight. The promises of eco‑friendly commerce evaporated like mist, leaving only a ghost of a contract on Ethereum. It feels almost tragic that a project so loudly pro‑environment ends up as a barren wasteland of unclaimed tokens.

Ken Lumberg

August 9, 2025 AT 10:50From an ethical standpoint, promoting a coin with no distribution is misleading at best and deceitful at worst. Investors deserve transparency, and hiding the fact that the circulating supply is essentially zero violates that principle. Projects should be held accountable for the promises they make to the community.

Blue Delight Consultant

August 19, 2025 AT 08:26The existence of WeeCoins forces us to confront the very nature of value in the digital age. When a token is minted but never reaches any wallet, what does it truly represent? Is it merely code, or does it embody an idea that failed to materialize? Philosophers have long debated whether intent alone can grant substance, yet the blockchain records only what is written, not what could have been. In the case of WeeCoins, the intention was to foster enviromentally conscious spending, but the platform never launched, leaving the promise dangling like an unfinished thesis. This gap between aspiration and execution echoes countless historical ventures that never escaped the drawing board. Moreover, the absence of a community mirrors a solitary mind without dialogue, and without dialogue, the token languishes in obscurity. The token's fixed total supply of 450 million, contrasted with a circulating supply of zero, is a stark numeric metaphor for unfulfilled potential. It reminds me of a hollow shell, echoing the emptiness of a stage left empty after the actors have left. Investors seeking meaning could interpret this as a cautionary tale about chasing hype over substance. The market's near‑zero volume underscores how liquidity is the lifeblood that pumps relevance into any asset; without it, even the most promising token becomes inert. One could argue that the token's very dormancy is a form of silent protest against the reckless proliferation of micro‑caps. Yet, silence can also be interpreted as a failure to engage, a missed opportunity for collective growth. From a regulatory perspective, such tokens raise eyebrows, as the lack of distribution could be seen as an attempt to circumvent securities laws. In practice, the token sits on the blockchain, waiting for a catalyst that may never arrive. Ultimately, WeeCoins serves as a digital relic, a footnote reminding us that without community, purpose, and transparent execution, even the most well‑intended projects fade into the ether.

Wayne Sternberger

August 29, 2025 AT 06:02Indeed, transparency forms the cornerstone of any reputable venture, and when that foundation is absent, trust erodes swiftly. In the realm of crypto, where anonymity is prized, the onus falls even heavier on clear communication. The tehran of undisclosed token allocation only fuels speculation, which inevitably leads to market instability. It's crucial that any future iterations of such projects prioritize open ledger practices and consistent community updates to rebuild credibility.

Gautam Negi

September 8, 2025 AT 03:38Contrary to popular belief, the lackluster performance of WeeCoins might actually be its greatest strength. By staying under the radar, the token avoids the volatile speculation that drags many micro‑caps into disastrous crashes. In a market awash with hype, quiet persistence could be a subtle strategy, waiting for the right moment to awaken.

Linda Campbell

September 18, 2025 AT 01:14While an understated approach can sometimes preserve value, the reality here is that there is essentially no value to preserve. The token's inactivity offers no strategic advantage; it simply reflects a failed execution that should be examined rather than romanticized. Investors deserve a candid assessment rather than a poetic justification.

Brian Elliot

September 27, 2025 AT 22:50It's helpful to look at this situation as a learning opportunity for new crypto projects. Building a robust community early on and ensuring token distribution can prevent the pitfalls we've seen with WeeCoins. Future creators might take these lessons to heart and design more sustainable ecosystems.

Mitch Graci

October 7, 2025 AT 20:26Wow!!! So many profound insights!!! 🙄🙄🙄 Who would have thought that community matters??? Clearly the crystal‑clear beacon of wisdom shines bright here!!! 😂😂😂

Jazmin Duthie

October 17, 2025 AT 18:02Yeah, because nobody ever learns from dead coins.

Michael Grima

October 27, 2025 AT 14:38Another golden nugget from the deep‑sea of crypto wisdom; the ocean is full of dead fish but we still pretend they're sushi.