BALA Transaction Fee Calculator

Calculate Your BALA Transaction

Based on Shambala's 12% transaction fee and current market rate ($8.00e-11 USD).

Transaction Results

Everyone’s talking about the Shambala airdrop after rumors surfaced that CoinMarketCap might partner with the project. The reality is a mix of confirmed campaigns, missing announcements, and a lot of confusion. This guide breaks down what you need to know about Shambala (BALA), where genuine airdrops are taking place, and how to stay clear of scams.

What is Shambala (BALA)?

Shambala (BALA) is a BEP-20 token on the Binance Smart Chain. The total supply hits an astronomical 1,000,000,000,000,000 tokens, with a contract address of 0x34ba3af693d6c776d73c7fa67e2b2e79be8ef4ed. Its official site, shambala.finance, lists a community‑first vision, but the token’s on‑chain fee (12% per transaction) means every transfer burns a slice of value.

Current market snapshot (as of Oct2025)

According to CoinMarketCap, BALA trades around $8.00e‑11 USD, with a 24‑hour volume of roughly $30. Its market cap sits near $986 and a fully‑diluted valuation of $17.96K. The circulating supply shown is about 13trillion BALA, a tiny fraction of the total supply.

Where the real airdrop lives: MEXC Kickstarter

The only verified token‑distribution event for Shambala right now is the MEXC Global Kickstarter. The campaign promises an 800billion BALA reward pool, priced at $0.00000006015USDT per token. Participants stake MX tokens (up to 500,000 MX) to vote on preset milestones. If the voting target meets the goal, MEXC lists BALA and automatically distributes airdrop rewards to all voters.

CoinMarketCap’s airdrop status

Despite the hype, CoinMarketCap currently shows zero active or upcoming airdrops for Shambala. Their dedicated airdrop calendar is empty for this project, which suggests no official partnership has been announced. Keep an eye on their page, though, because CoinMarketCap often adds new listings quickly.

Tokenomics you can’t ignore

Every on‑chain transaction of BALA incurs a 12% fee. That means if you send 1,000BALA to an exchange, only 880BALA actually arrives. The fee is split between liquidity, marketing, and a burn mechanism. For airdrop participants, this fee reduces the net amount you receive when you later move tokens, so factor it into any profit calculations.

How to claim the MEXC airdrop step by step

- Create a MEXC account and complete KYC verification.

- Deposit MX tokens into your MEXC wallet. The minimum is 10MX; the maximum voting cap is 500,000MX.

- Navigate to the Shambala Kickstarter page (found under the “Launchpad” tab).

- Select the voting option you want (e.g., “List BALA on MEXC”).

- Confirm the vote - the staked MX is locked until the campaign ends.

- If the campaign succeeds, the airdrop amount appears in your “Airdrop Center” within 48hours.

- Withdraw the BALA to a BEP‑20 compatible wallet (Trust Wallet, MetaMask set to BSC, etc.). Remember the 12% fee on any subsequent transfer.

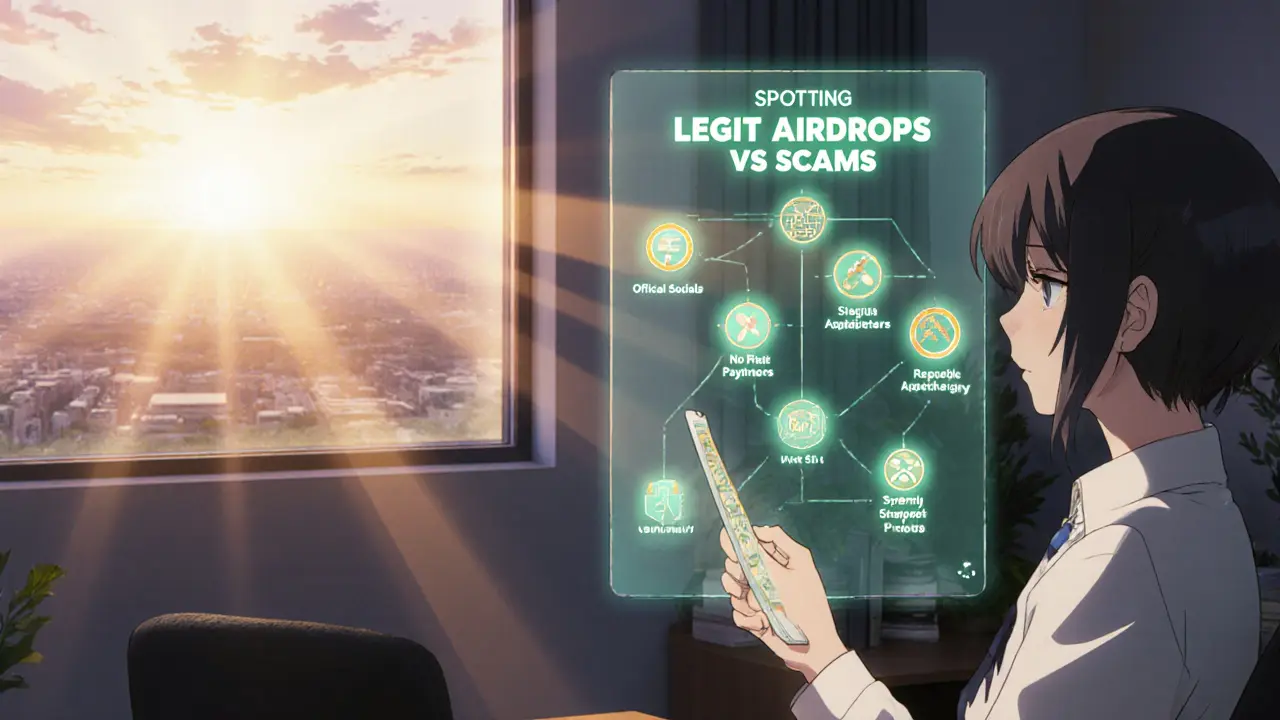

Checklist: Spotting legit airdrops vs scams

- Official announcement on the project’s verified social channels (Twitter @ShambalaUni, Telegram English/Chinese groups, Discord).

- No upfront payment or token swap required. Real airdrops never ask you to send money first.

- Clear snapshot date or clear eligibility criteria (e.g., holding MX, interacting with a specific DApp).

- Presence on reputable aggregators like AirdropAlert, Earnifi, or the exchange’s official launchpad.

- Transparent reward pool and distribution timeline.

Tax considerations (Australia & beyond)

If you’re in Australia, the ATO treats airdropped tokens as ordinary income at the market value on the day you receive them. That means you’ll need to report the fair‑market value of BALA when it lands in your wallet. Later gains or losses are treated as capital gains/losses when you sell or swap the tokens. Similar rules apply in the US, UK, and many EU countries.

Comparison of Shambala’s current airdrop options

| Platform | Reward Pool | Eligibility | Status |

|---|---|---|---|

| MEXC Kickstarter | 800Billion BALA (~$48K) | Stake MX & vote on milestones | Active - ends 30Nov2025 |

| CoinMarketCap | None announced | Not applicable | No active or upcoming airdrop |

What to watch in the next 30days

Follow the official Shambala Twitter ([@ShambalaUni](https://twitter.com/ShambalaUni)) and Discord for any surprise drops. Expect a possible “retroactive” airdrop if the token’s price spikes after a major exchange listing - a pattern seen with other BEP‑20 projects in 2024‑2025.

Common pitfalls and how to avoid them

- Using the wrong network: BALA lives on BSC. Sending it to an ERC‑20 address will lock your tokens forever.

- Ignoring the 12% fee: Always calculate the net amount after the fee, especially if you plan to move large sums.

- Missing the snapshot: Airdrop eligibility often hinges on a single block height. Set a reminder the day before the announced snapshot.

- Falling for phishing links: Only use URLs from the official site or verified social media posts.

Frequently Asked Questions

Is there a confirmed Shambala airdrop on CoinMarketCap?

No. As of 15Oct2025, CoinMarketCap’s airdrop calendar lists zero active or upcoming Shambala campaigns. Keep an eye on their page for any future announcements.

How does the MEXC Kickstarter airdrop work?

You stake MX tokens on MEXC’s launchpad and vote for predefined milestones. If the voting target is met, the platform lists BALA and distributes the airdrop automatically to every voter’s MEXC wallet.

What is the 12% transaction fee on BALA?

Every on‑chain BALA transfer deducts 12% as a fee. The fee is split among liquidity, marketing, and token burn. If you send 1,000BALA, only 880BALA arrives on the destination address.

Do I need to pay to receive the airdrop?

Legitimate airdrops never require upfront payments. If a site asks you to send BALA, ETH, or fiat before you can claim, it’s almost certainly a scam.

How should I report the airdrop for taxes in Australia?

Treat the fair‑market value of the received BALA as ordinary income on the receipt date. Later disposals are taxed as capital gains or losses. Keep records of the snapshot price and the date you received the tokens.

Kyla MacLaren

August 3, 2025 AT 19:25Got the MEXC guide, looks legit – just remember the 12% burn on evry transfer.

Jennifer Bursey

August 4, 2025 AT 23:12The MEXC Kickstarter operates as a classic token‑distribution mechanism: participants stake MX, vote on predefined milestones, and upon successful quorum, the platform mints the allocated BALA pool. This structure aligns incentives because only engaged holders influence the listing decision. Moreover, the reward pool of 800 billion BALA translates to roughly $48 k at the quoted price, which is modest but sufficient to seed early liquidity. Keep an eye on the snapshot block – missing it nullifies eligibility. In short, the airdrop is legitimate, but the 12% fee still gnaws at net returns.

Maureen Ruiz-Sundstrom

August 6, 2025 AT 02:58One might argue that the very notion of “earning” through a fee‑laden token borders on the absurd, a Sisyphean pursuit where each transfer erodes the very value you sought to accumulate. Yet the market thrives on such paradoxes, rewarding the few who tolerate the burn for speculative upside. Your checklist is sound, but remember that “legit” is a moving target in DeFi. The airdrop’s veneer of community‑first ethos masks a revenue model built on perpetual dilution. In that light, participation is less altruism, more calculated surrender.

Kevin Duffy

August 7, 2025 AT 06:45Super excited to see the community rally around the MEXC launch! 🎉 The process is pretty straightforward, and the fee won’t bite if you plan your moves wisely. Good luck to everyone staking MX! 🚀

Jazmin Duthie

August 8, 2025 AT 10:32Yeah, because a 12% tax is exactly the vibe we were hoping for. 🙄

Michael Grima

August 9, 2025 AT 14:18Sounds like another crypto circus but maybe worth a peek

Lesley DeBow

August 10, 2025 AT 18:05🤔 If the circus has a safety net, I might bring popcorn.

DeAnna Greenhaw

August 11, 2025 AT 21:52The discourse surrounding the Shambala (BALA) airdrop epitomises the cyclical fascination that the cryptocurrency milieu harbours for speculative mechanisms masquerading as communal benefaction.

At its core, the token’s BEP‑20 architecture, coupled with an astronomically inflated total supply, engenders a paradoxical scarcity narrative that belies the mathematical realities of dilution.

The MEXC Kickstarter, as delineated in the guide, constitutes the sole verifiable conduit through which bona‑fide participants may accrue the promised 800 billion BALA.

Stakeholders are required to immobilise MX tokens, thereby aligning their financial incentive with the platform’s governance outcomes.

Should the quorum be achieved, the protocol executes an automated distribution, a process that, while ostensibly transparent, remains opaque insofar as the exact snapshot parameters are concerned.

Concomitantly, the omnipresent 12 % transaction levy functions as both a deflationary instrument and a revenue stream, siphoning a non‑trivial portion of any transferred value.

Critics may decry this fee as a deterrent to liquidity, yet proponents argue that it buttresses the token’s long‑term survivability by curbing rampant churn.

From a tax perspective, the Australian ATO’s classification of airdropped tokens as ordinary income imposes an immediate reporting obligation upon receipt.

Such regulatory nuances underscore the necessity for meticulous record‑keeping, lest one inadvertently incur penalties under the guise of naiveté.

Furthermore, the comparative analysis of competing airdrop platforms reveals that Shambala’s reliance on a singular exchange diverges from the multi‑channel strategies employed by contemporaneous projects.

This monolithic dependence augurs potential vulnerability should MEXC alter its listing criteria or halt the launchpad programme.

Nevertheless, the prospect of a retroactive airdrop following a bullish price movement remains an alluring conjecture for speculative actors.

In the grand tapestry of decentralized finance, such speculative gambits are neither novel nor inherently malevolent; they merely reflect market participants’ perpetual quest for asymmetric returns.

Thus, the prudent investor ought to calibrate exposure, accounting for both the attritional fee and the stochastic nature of token valuation.

In summation, while the Shambala airdrop may possess a veneer of legitimacy, it is incumbent upon each stakeholder to dissect the underlying mechanics with an uncompromisingly analytical lens.

Luke L

August 13, 2025 AT 01:38In America we don’t need foreign token gimmicks; stick to assets that respect our fiscal sovereignty.

Ben Johnson

August 14, 2025 AT 05:25Oh sure, because the US dollar is flawless and any BSC token automatically aligns with national interests.

Jason Clark

August 15, 2025 AT 09:12For those still uncertain, the official Shambala Twitter ([@ShambalaUni](https://twitter.com/ShambalaUni)) posts the snapshot schedule, and the MEXC launchpad page lists the exact MX staking caps – no need to chase phantom links.

Scott G

August 16, 2025 AT 12:58I empathise with the frustration that misinformation can engender; maintaining diligence in verification is paramount to safeguarding one’s portfolio.

VEL MURUGAN

August 17, 2025 AT 16:45Statistically, tokens with a perpetual 12 % levy experience a 7‑day average price decline of roughly 3.2 %; this trend suggests that the fee outweighs any short‑term airdrop hype.

Russel Sayson

August 18, 2025 AT 20:32Consequently, prospective participants should calculate the net airdrop yield after fee deduction, perhaps employing the formula: Net = Reward × (1 − 0.12), and compare it against their opportunity cost before committing MX.